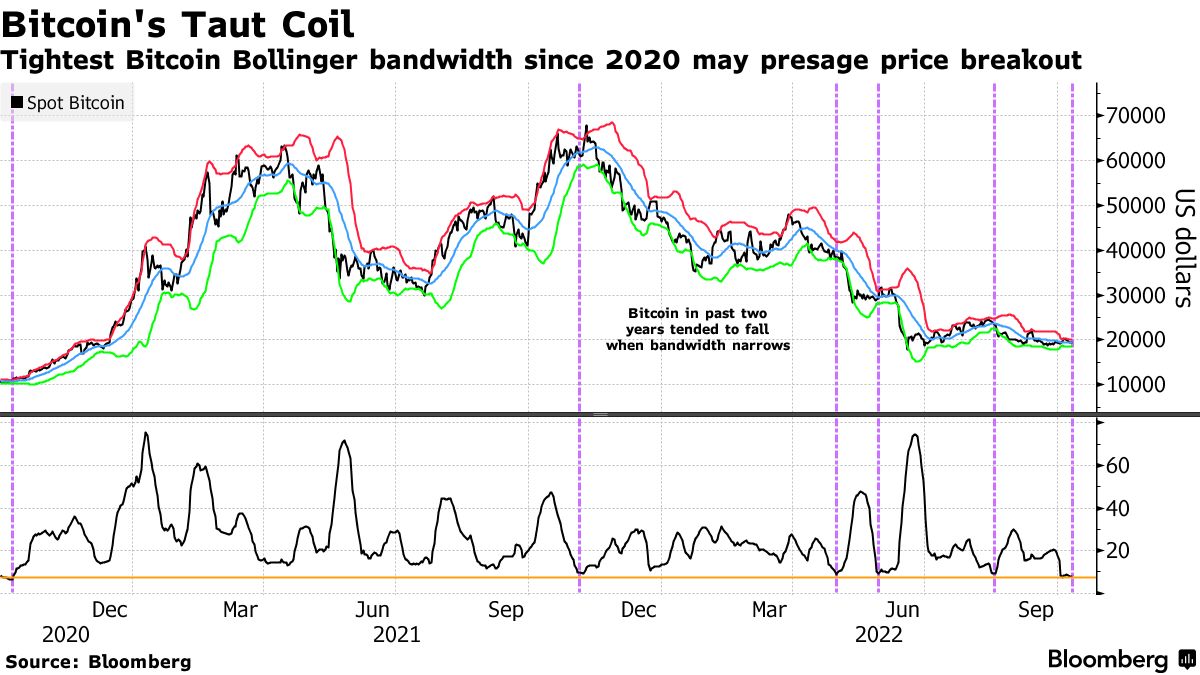

If history is any indication, the biggest cryptocurrency in terms of market capitalization, Bitcoin, may be bracing for a volatility spike and a lurch lower. In recent months, Bitcoin — which is well known for its volatility — has been relatively calm, oscillating in a rather narrow range around the $20,000 level after it touched lows of $17,600 in June.

Pasak "Bloomberg" analizė, the Bollinger Bandwidth, a potentially ominous signal, has now shrunk to its narrowest since 2020. The bandwidth in a Bollinger analysis, a common method of determining volatility, is the distance between the upper and lower bands.

As a result, some analysts see the narrow Bollinger Bandwidth as a sign that Bitcoin price volatility might spike and, thus, reduce its price.

A nearly 60% decline in the price of Bitcoin this year resulted from a global wave of monetary tightening to combat inflation. Since touching a $3 trillion peak in November 2021, cryptocurrencies have lost around $2 trillion, which has forced regulators to tighten control.

Additionally, the world markets are anticipating Thursday’s U.S. inflation data. A strong result might fuel expectations of additional Federal Reserve interest-rate increases, shaking up a variety of assets, while a significant slowdown might have the opposite effect. Market observers anticipate Bitcoin being largely macro-driven in the near term.

Bitcoin must sustain above $19K

#Bikcoinas | Praradus 19,000 XNUMX USD paramos lygį, gali kilti problemų! https://t.co/U81bjTS2bE

– Ali (@ali_charts) Spalis 10, 2022

Kriptovaliutų analitikas ali teigia, kad Bitcoin turi išlaikyti 19 1.3 USD paramos lygį, kad būtų išvengta staigaus nuosmukio. Šiuo kainų lygiu 680,000 milijono adresų įsigijo daugiau nei XNUMX XNUMX BTC, o grandinės duomenys rodo, kad žemiau jo palaikymo yra mažai arba visai nėra.

At the time of publication, BTC was trading marginally down at $19,334.

Tinklo analizės įmonė Stiklinis mazgas reports that the on-chain cost basis for Bitcoin short-term holders has crossed below that of long-term holders. This might imply that buyers of BTC over the last five months now have a superior cost basis to those who “HODLed” through all the volatility of the 2020–2022 cycle.

Source: https://u.today/bitcoin-might-be-in-serious-trouble-based-on-this-chart-indicator