Fidelity’s director of global macro Jurrien Timmer is updating his long-term forecasts for Bitcoin (BTC) as the leading crypto asset by market cap struggles near the $30,000 mark.

Ilgai sriegis, Timmer makes reference to quant analyst PlanB’s once popular stock-to-flow model (S2F), which attempted to predict the price of Bitcoin based on supply shocks stemming from BTC halvings.

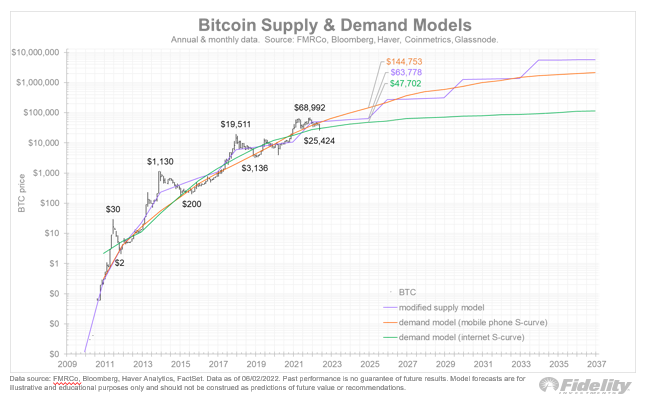

Timmer presents an S2F-inspired supply model, plus two more models that track the adoption rates of the internet and mobile phones.

According to Timmer’s modified supply model, Bitcoin could be somewhere around $63,778 by 2025, about a year after the next BTC halving.

“The close-up below shows that this more modest supply model has been (in hindsight) more accurate than the original S2F’s projections for this halving cycle.”

Timmer says that based on the adoption of mobile phones, Bitcoin could explode in value and trade at $144,753 by 2025. But if Bitcoin follows the adoption rate of the internet, Timmer’s model suggests BTC has topped out and could trade at $47,702 in three years.

“Assuming the mobile phone curve is a more viable analog, its curve suggests a strongly growing network for Bitcoin in the years ahead, but the more asymptotic internet curve raises the possibility that perhaps Bitcoin’s growth curve is more mature than my models have assumed…

I remain bullish on Bitcoin as an aspiring store of value in a world of ongoing financial repression, but the above exercise is a good reminder that we should always revisit our assumptions, especially when the price action deviates from expectations.”

Tikrinti Kaina veiksmų

Nepraleisk ritmo - Prenumeruok kad kriptografiniai el. pašto įspėjimai būtų pristatyti tiesiai į jūsų gautuosius

Sekite mus Twitter, Facebook ir Telegram

Surf „Daily Hodl Mix“

Atsisakymas: „The Daily Hodl“ išsakytos nuomonės nėra patarimas dėl investavimo. Investuotojai turėtų atlikti deramą patikrinimą prieš imdamiesi bet kokių didelės rizikos investicijų į „Bitcoin“, kriptovaliutą ar skaitmeninį turtą. Informuojame, kad už savo pervedimus ir sandorius esate atsakingi patys, o už visus nuostolius, kuriuos galite patirti, esate atsakingas jūs. „Daily Hodl“ nerekomenduoja pirkti ar parduoti jokios kriptovaliutos ar skaitmeninio turto, taip pat „The Daily Hodl“ nėra patarėjas dėl investavimo. Atkreipkite dėmesį, kad „The Daily Hodl“ dalyvauja filialų rinkodaroje.

Paveikslėlis: Shutterstock / Larich

Source: https://dailyhodl.com/2022/06/06/fidelity-macro-analyst-makes-long-term-bitcoin-forecast-using-new-trading-models/