A leading crypto analytics firm is looking at what’s under the hood of Bitcoin to see what’s powering BTC’s latest rally.

In a new video, Glassnode says that short sellers, or those who were betting on the sustained drop of Bitcoin’s price, were responsible for carving out a bottom for BTC.

“Short liquidations typically happen when we have very violent upswings. Essentially, people get very comfortable with it with a market trend. They see it going down, and down and down… Eventually, they feel confident enough and go, ‘You know what? I’m tired of being squeezed out of my long position. I’m going to go short.’ Impressively, they managed to do that at the exact bottom, and then they get squeezed out in the opposite direction, and the trend starts to change.”

Looking at Glassnode’s chart, the shift in trend appears to have started on February 24th when short liquidations skyrocketed as BTC traded around $37,000.

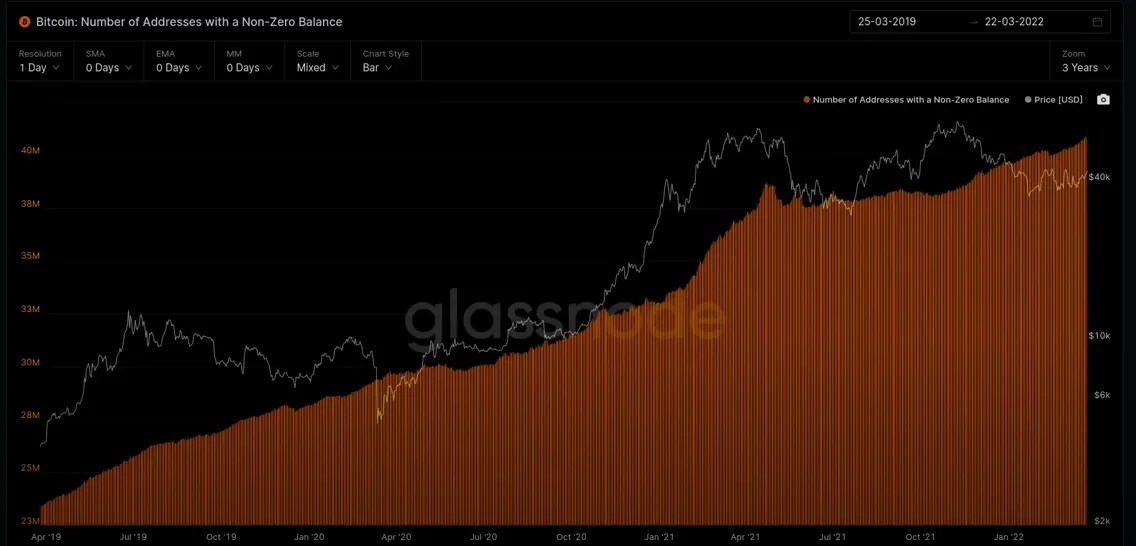

As short sellers fuel BTC’s initial leg up, Glassnode highlights that the rally wouldn’t be sustained without organic demand. The analytics firm says it is looking at Bitcoin’s number of addresses with a non-zero balance metric to show that investors continue to buy BTC in spite of the macroeconomic backdrop.

“What we can see is that over the last couple of weeks, notice how we’ve actually seen a bit of an acceleration. It’s really starting to curl to the upside. So we are seeing that people, even though we’re at depressed prices and even though we’ve been in what I would call a bear market… Despite all of that, all of the geopolitical uncertainties, the macro headwinds, the Fed hiking rates – all of the risks in the economy right now – people are still accumulating BTC.”

According to Glassnode, another metric that shows the growing demand for Bitcoin is BTC’s number of accumulation addresses. The insights firm defines the metric as the number of addresses that continue to add BTC to their stacks.

Sako Glassnode,

“Over the recent weeks, note how much this has ticked higher. Very, very significant uptick in overall accumulation balance so it’s showing that we do have more and more people in the immediate term who are stacking. It’s painting a picture that we’ve got short squeeze on one side but it also appears that there’s a true organic demand that we can see through address growth.

I

Tikrinti Kaina veiksmų

Nepraleisk ritmo - Prenumeruok kad kriptografiniai el. pašto įspėjimai būtų pristatyti tiesiai į jūsų gautuosius

Sekite mus Twitter, Facebook ir Telegram

Surf „Daily Hodl Mix“

Atsisakymas: „The Daily Hodl“ išsakytos nuomonės nėra patarimas dėl investavimo. Investuotojai turėtų atlikti deramą patikrinimą prieš imdamiesi bet kokių didelės rizikos investicijų į „Bitcoin“, kriptovaliutą ar skaitmeninį turtą. Informuojame, kad už savo pervedimus ir sandorius esate atsakingi patys, o už visus nuostolius, kuriuos galite patirti, esate atsakingas jūs. „Daily Hodl“ nerekomenduoja pirkti ar parduoti jokios kriptovaliutos ar skaitmeninio turto, taip pat „The Daily Hodl“ nėra patarėjas dėl investavimo. Atkreipkite dėmesį, kad „The Daily Hodl“ dalyvauja filialų rinkodaroje.

Paveikslėlis: Shutterstock / Kiselev Andrey Valerevich

Source: https://dailyhodl.com/2022/03/28/heres-whats-sustaining-the-latest-bitcoin-btc-surge-according-to-analytics-firm-glassnode/