Leading digital asset manager CoinShares says that many institutional investors appear to be showing more caution towards Bitcoin and positioning themselves as short-sellers on BTC.

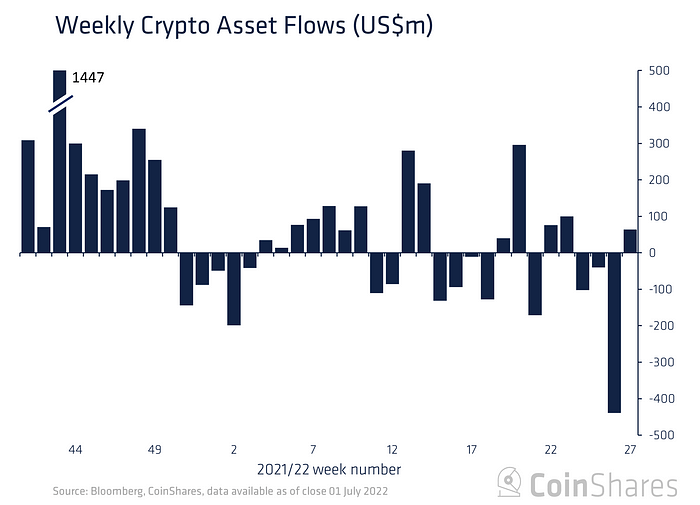

Naujausiame skaitmeninio turto fondų srautų kas savaitę pranešti, CoinShares finds digital asset investment products saw a positive week of inflows, mostly stemming from allocations to short-Bitcoin products.

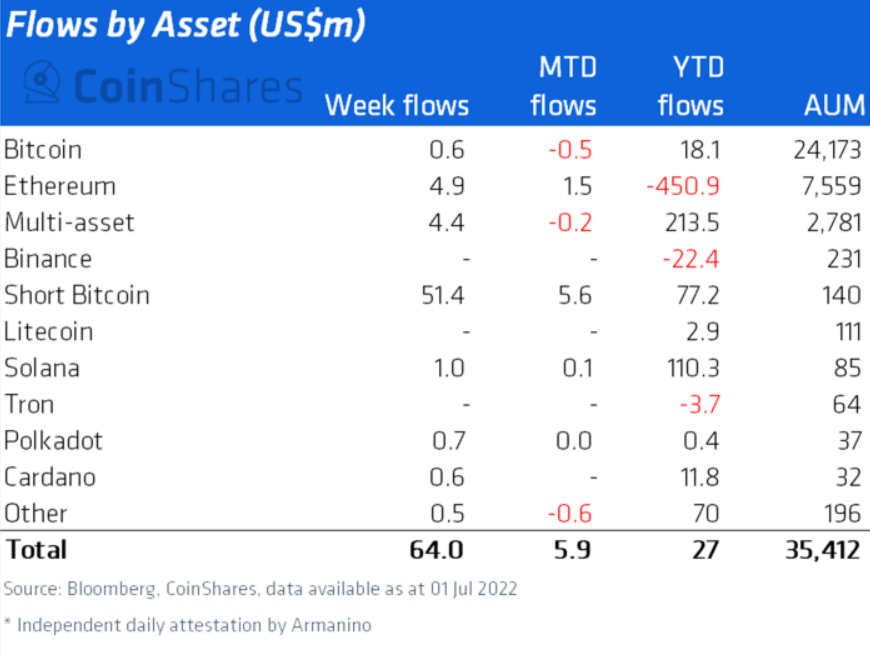

“Digital asset investment products saw inflows totaling $64 million last week, although the headline figures obscure the fact that a significant majority were into short-Bitcoin investment products ($51 million).”

As mentioned, 79% of the inflows derive from short-Bitcoin (BTC) investment products, or products seeking to borrow Bitcoin to sell on the market before repurchasing it at a lower price.

Small inflows in long Bitcoin investment products perhaps support the bearish argument, according to the firm.

“Small inflows were seen into long investment products in regions other than the US such as Brazil, Canada, Germany and Switzerland totaling US $20 million.

This highlights investors are adding to long positions at current prices, with the inflows into short-Bitcoin possibly due to first-time accessibility in the US rather than renewed negative sentiment.

Bitcoin saw little inflows over the week, totaling just US $0.6 million. Short-Bitcoin saw record inflows totaling US $51 million after the product launch in the US.”

CoinShares is referring to the ProShares launch of the Short Bitcoin Strategy ETF (BITI) on June 21.

Ethereum (ETH), J. Solana (SOL) Polkadot (DOT), Cardano (ADA) and multi-asset crypto investment products all enjoyed inflows on the week, bringing in $4.9 million, $1 million, $0.7 million, $0.6 million and $4.4 million, respectively.

Tikrinti Kaina veiksmų

Nepraleisk ritmo - Prenumeruok kad kriptografiniai el. pašto įspėjimai būtų pristatyti tiesiai į jūsų gautuosius

Sekite mus Twitter, Facebook ir Telegram

Surf „Daily Hodl Mix“

Atsisakymas: „The Daily Hodl“ išsakytos nuomonės nėra patarimas dėl investavimo. Investuotojai turėtų atlikti deramą patikrinimą prieš imdamiesi bet kokių didelės rizikos investicijų į „Bitcoin“, kriptovaliutą ar skaitmeninį turtą. Informuojame, kad už savo pervedimus ir sandorius esate atsakingi patys, o už visus nuostolius, kuriuos galite patirti, esate atsakingas jūs. „Daily Hodl“ nerekomenduoja pirkti ar parduoti jokios kriptovaliutos ar skaitmeninio turto, taip pat „The Daily Hodl“ nėra patarėjas dėl investavimo. Atkreipkite dėmesį, kad „The Daily Hodl“ dalyvauja filialų rinkodaroje.

Teminis vaizdas: Shutterstock/yuhu/maksum iliasin

Source: https://dailyhodl.com/2022/07/04/institutions-turn-cautious-on-bitcoin-as-short-btc-products-see-record-inflows-coinshares/