The CEO of leading on-chain analytics firm CryptoQuant says one metric is flashing a massive red flag for Bitcoin (BTC) bulls.

Ki Young Ju tells his 292,600 Twitter followers that historical data rodo Bitcoin could plummet all the way down to $14,000.

“So here’s hopium for bears.

If BTC crashed so hard due to the macro crisis and all Bitcoiner institutions go underwater, it could go $14,000 based on historical maximum drawdown.”

Rašant, Bitcoin is down 3.58% and priced at $29,240. A move to the analyst’s bearish price target suggests a 52% downside risk for BTC.

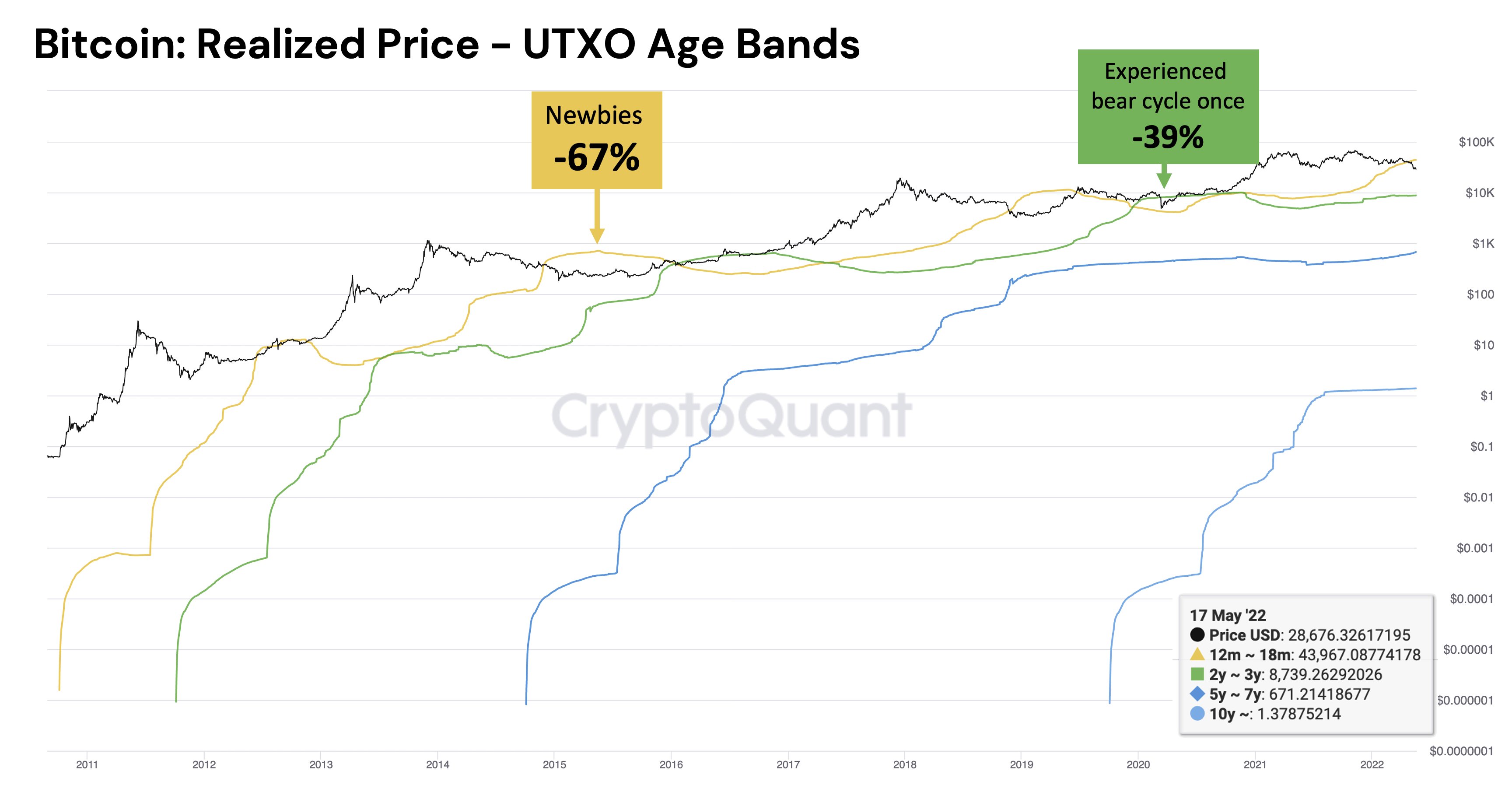

According to the quant analyst, the most recent Bitcoin investors will likely be deep underwater should market prices fall into his worst-case scenario.

“Bitcoin maximum drawdown in worst-case scenario.

Newbies down 67%.

Experienced one bear cycle – down 39%.

Experienced two bear cycles – profit guaranteed.

Experienced three bear cycles – profit guaranteed.

Today, newbies who joined last year are in -34% loss.”

Ki Young Ju next suteikia the average entry price for each generation of Bitcoin investors over its 11 years in existence by following the UTXO age bands metric, which takeliai the potential price level where long-term holders accumulated BTC.

#Bikcoinas OG’s Entry Price:

1st gen – $1.3

2nd gen – $653

3rd gen – $8,717

4th gen – $43,582I’m the 3rd gen. Hang in there, 4th gen. pic.twitter.com/iWkEwFO4zV

– Ki Young Ju (@ki_young_ju) Gali 14, 2022

The analyst also recently pastebėta that institutional investors are now the dominant force in Bitcoin trading.

„Mažmeniniai investuotojai palieka kriptovaliutų rinką. Neblogai kaupti Bitcoin institucijose, bet vis tiek nerimauju dėl bendros apimties, kuri, palyginti su praėjusiais metais, gerokai sumažėjo.

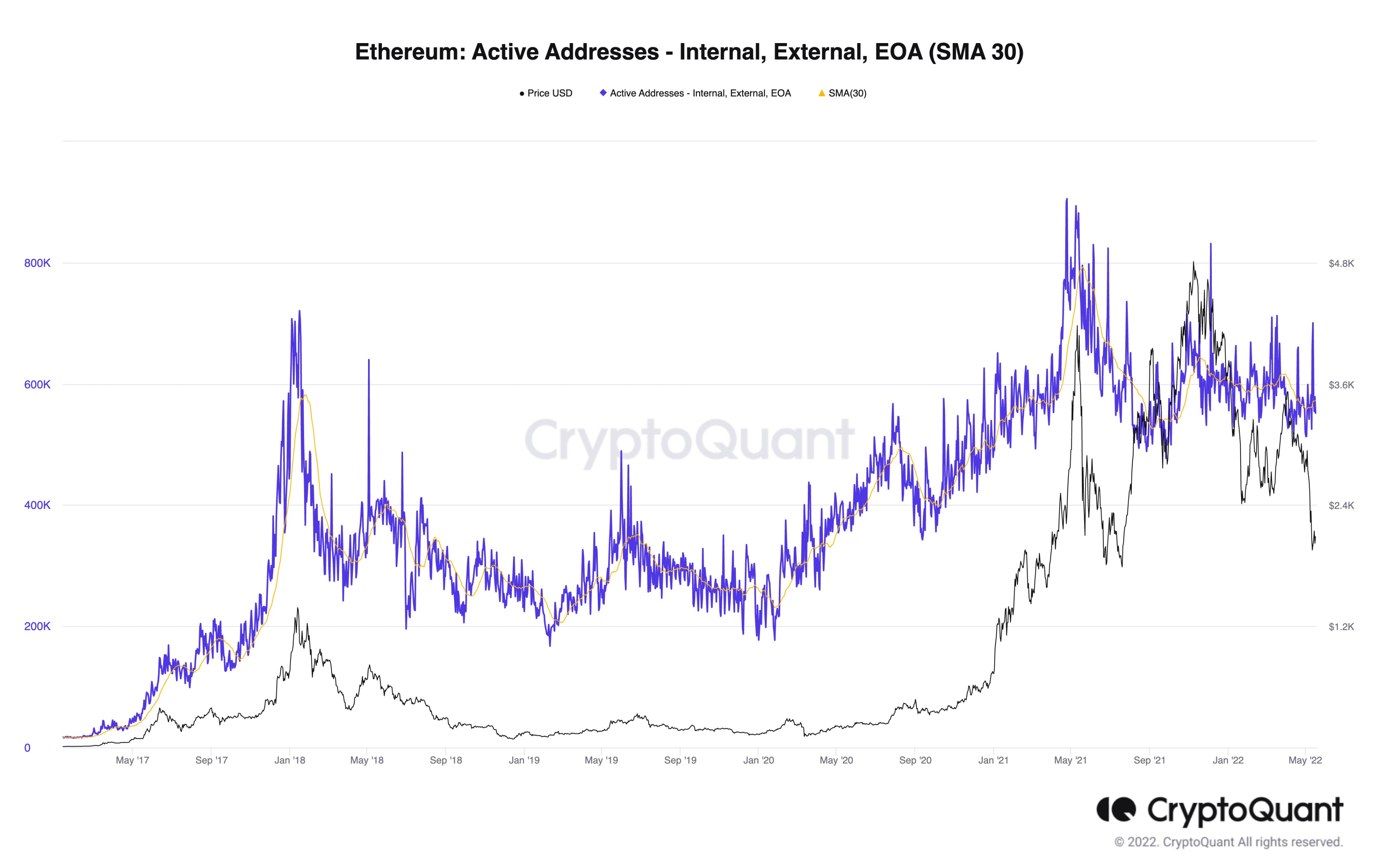

The CryptoQuant CEO next looks at leading smart contract platform Ethereum (ETH). He pabrėžia that the ETH ecosystem remains strong despite a massive decline in price due to heavy interest in new blockchain niches like decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs) and play-to-earn blockchain games (GameFi).

“ETH price dropped -56% from the top, but the number of active addresses just decreased by 7%.

If we consider each address as a user, Ethereum has 551,705 DAU (Daily Active Users) today.

These degens don’t care about ETH price but ape into DeFi, NFT, DAO, and GameFi projects.”

Ethereum is also down by 2.57%, changing hands for $1,965.

Tikrinti Kaina veiksmų

Nepraleisk ritmo - Prenumeruok kad kriptografiniai el. pašto įspėjimai būtų pristatyti tiesiai į jūsų gautuosius

Sekite mus Twitter, Facebook ir Telegram

Surf „Daily Hodl Mix“

Atsisakymas: „The Daily Hodl“ išsakytos nuomonės nėra patarimas dėl investavimo. Investuotojai turėtų atlikti deramą patikrinimą prieš imdamiesi bet kokių didelės rizikos investicijų į „Bitcoin“, kriptovaliutą ar skaitmeninį turtą. Informuojame, kad už savo pervedimus ir sandorius esate atsakingi patys, o už visus nuostolius, kuriuos galite patirti, esate atsakingas jūs. „Daily Hodl“ nerekomenduoja pirkti ar parduoti jokios kriptovaliutos ar skaitmeninio turto, taip pat „The Daily Hodl“ nėra patarėjas dėl investavimo. Atkreipkite dėmesį, kad „The Daily Hodl“ dalyvauja filialų rinkodaroje.

Featured Image: Shutterstock/kilshieds

Source: https://dailyhodl.com/2022/05/21/one-metric-indicates-bitcoin-btc-could-crash-by-over-50-as-macro-environment-worsens-says-cryptoquant-ceo/