On-chain data shows Bitcoin hasn’t yet hit a bear market bottom as the supply in profit is still more than that in loss.

Bitcoin Supply In Profit/Loss Says A Majority Of Network Is Still In Profit

Kaip paaiškino CryptoQuant analitikas paštu, past trend may suggest that the current BTC market still hasn’t reached a bear bottom.

The relevant indicators here are the “pasiūla pelne” and the “supply in loss.” These metrics measure what percent of the total Bitcoin supply is in profit and what part of it is in loss, respectively.

The indicators work by checking the on-chain history of each coin to see what price it was last moved at. If this previous value was less than the price of BTC today, then the coin is currently holding a profit.

Susiję skaitymai Duomenys rodo, kad didelės institucijos vis dar aktyviai prekiauja Bitcoin ne biržoje

On the other hand, the last selling price being more than the current one would imply this coin counts under the supply in loss at the moment.

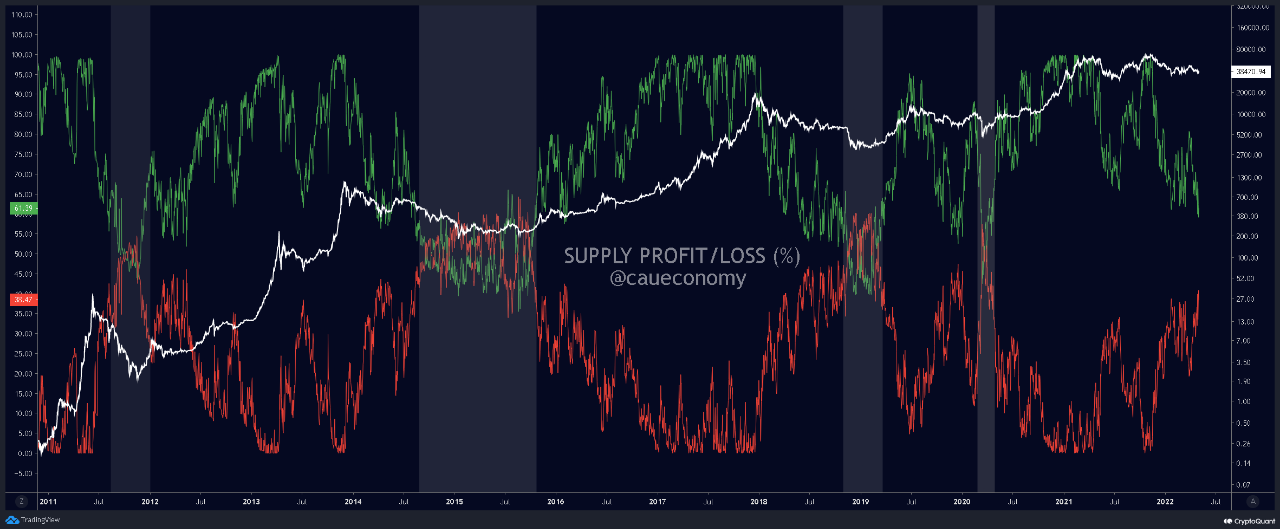

Now, here is a chart that shows the trend in the two Bitcoin indicators over the history of the crypto:

It seems like the majority of the BTC network is still in profit | Source: „CryptoQuant“

In the above graph, the analyst has marked the important regions of trend relating the indicators and the price of Bitcoin.

It looks like bear market bottoms have historically formed whenever the supply in loss has exceeded that in profit.

Such high loss values occur following macro capitulations. From the chart, it’s clear that the supply in profit is currently still dominating that in loss.

The supply in loss measures around 38% right now. If the past trend is anything to go by, Bitcoin at the moment doesn’t look to have reached a bear market bottom yet.

Nonetheless, the current supply in loss values are still very high and not too far off from the bottom tipping point.

Susiję skaitymai „Wall Street“ milžinas „Goldman Sachs“ kuria istoriją ir siūlo pirmąją „Bitcoin“ paskolą

It now remains to be seen whether the market observes another capitulation event soon, which would take the supply in profit below the 50% mark.

A bear market bottom may form that way, but the price of the crypto will observe another crash in such a scenario.

BTC kaina

Rašymo metu Bitcoin kaina svyruoja apie 38.6 tūkst. USD, praėjusią savaitę sumažėjo 1%. Per pastarąjį mėnesį kriptovaliuta prarado 16% vertės.

Žemiau esančioje diagramoje parodyta monetos kainos tendencija per pastarąsias penkias dienas.

Looks like the price of BTC has dwindled down over the last few days | Source: BTCUSD „TradingView“

Featured image from Pixabay.com, charts from TradingView.com, CryptoQuant.com

Source: https://bitcoinist.com/indicator-bitcoin-still-reached-bear-market-bottom/