TL; DR suskirstymas

- Binance Coin price analysis suggests sideways movement with potential downwards movement

- Artimiausias palaikymo lygis siekia 265 USD

- BNB susiduria su pasipriešinimu 273 USD ženklu

Šios Binansas Coin price analysis shows that the price has been trading in a sideways motion with low movement beyond the mean position at $270.00.

Platesnė kriptovaliutų rinka pastarąsias 24 valandas stebėjo nevienodą rinkos nuotaiką, nes dauguma pagrindinių kriptovaliutų fiksuoja nevienodus kainų pokyčius. Pagrindiniai žaidėjai yra XRP ir ICP, užfiksuojantys atitinkamai 2.43 procento nuolydį ir 1.71 procento nuosmukį.

Binance Coin kainų analizė: BNB grįžta prie 280 USD

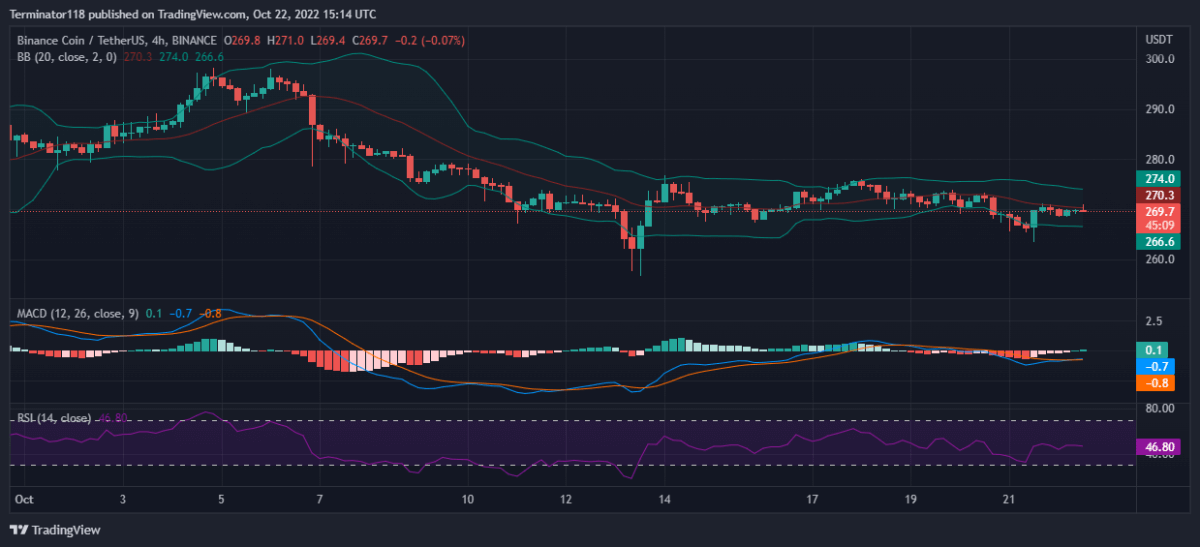

The MACD is currently bullish, as expressed in the green color of the histogram. However, the indicator shows low bullish momentum as the indicator has only recently exhibited a bullish crossover. Moreover, the darker shade of the histogram suggests an increasing buying activity in the short term as the price returns to the $270 mark.

EMA šiuo metu prekiauja žemiau vidutinės pozicijos, nes grynasis kainų pokytis per pastarąsias dešimt dienų yra neigiamas. Tačiau dviem EMA pasisukus į viršų, tikimasi, kad meškų aktyvumas sumažės, o 12-EMA suartės su 26-EMA. Šiuo metu EMA siūlo didinti pardavimo spaudimą, kai kaina grįžta prie 270 USD ribos.

The RSI was trading on the overhead region yesterday as the index dropped to the 30.00 index unit level. Currently, the indicator has moved back upwards towards the mean level but trades at 46.80 unit level at press time, suggesting slight bearish momentum. On the other hand, the horizontal slope of the indicator suggests a struggle between the buyers and sellers for dominance.

The Bollinger Bands were diverging recently as the price broke down the $265.00 mark. However, as the price returned to the $268.00 level, the bands started to converge, suggesting increasing price stability at the price level. The indicator’s bottom line currently provides support at the $266.50 mark, while the upper line presents resistance at the $273.90 mark.

Techninės BNB/USDT analizės

Apskritai, 4 val Binance Monetos kaina analysis issues a sell signal, with 13 of the 26 major technical indicators supporting the bears. On the other hand, only three of the indicators support the bulls showing a low bullish presence in recent hours. At the same time, ten indicators sit on the fence and support neither side of the market.

24 valanda Binansas Coin price analysis accentuates this sentiment and also issues a sell signal, with 14 indicators suggesting a downward movement against only two indicators suggesting an upward movement. The analysis shows the bearish dominance across the mid-term charts while showing low buying pressure for the asset across the same timeframe. Meanwhile, ten indicators remain neutral and do not issue any signals at press time.

Ko tikėtis iš Binance Coin kainų analizės?

The Binance Coin price analysis shows that after crashing below the $267.00 mark, the price action found support at the $265.00 mark enabling the bulls to fight back. Currently, the bulls are moving back toward the $270.00 mark as the buyers push back. However, the bearish pressure is yet to subside, and the price continues its consolidation around the $270.00 mark.

Traders should expect BNB to continue to move sideways between the $275 and the $265 mark as the bearish pressure exhausts the buying activity in the markets. This movement can be expected to be breached by the bears with a potential drop down to the $250.00 mark, as suggested by the mid-term technical analyses.

Šaltinis: https://www.cryptopolitan.com/binance-coin-price-analysis-2022-10-22/