Paskelbta prieš 3 valandas

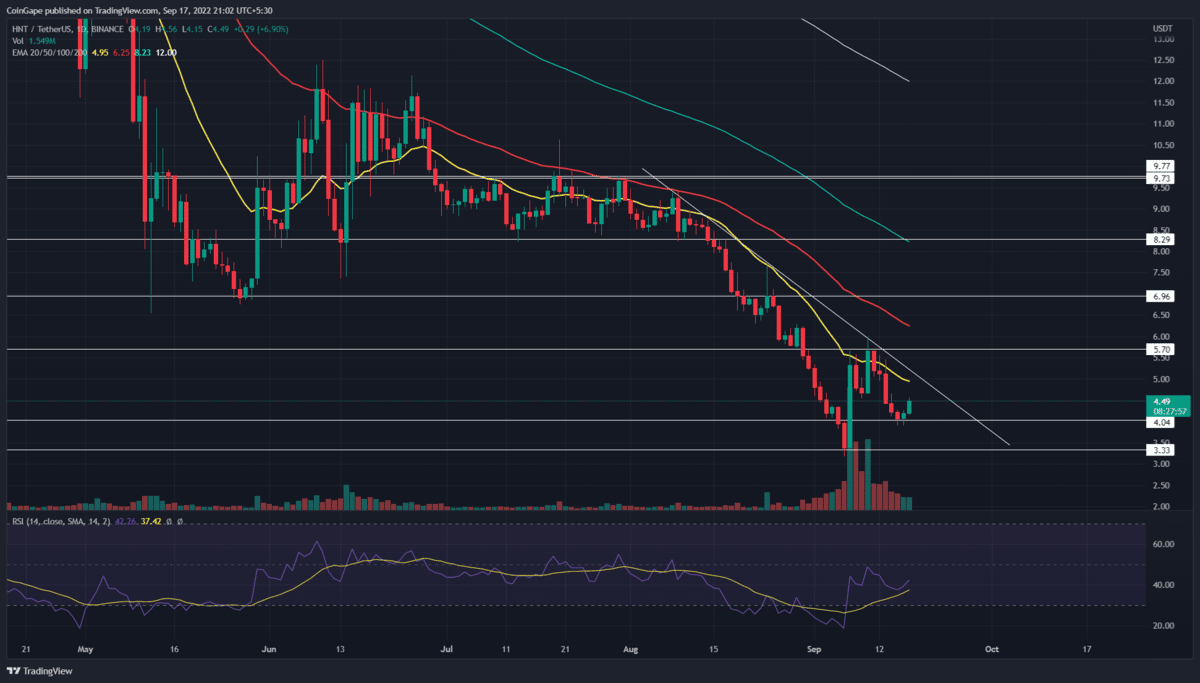

A bukas atsigavimas from the newly obtained $4 support sets the Helium coin price to hit a monthly resistance trendline. However, the low volume aligned with this recovery hints the prices are witnessing a minor relief rally. Thus, a potential reversal from the falling trendline could extend the ongoing correction below $3.33.

Pagrindiniai klausimai:

- The Helium price could resume prevailing correction from the downsloping trendline

- The resistance trendline may trigger a new recovery rally

- Dienos prekybos helio moneta apimtis yra 17.5 mln. USD, o tai rodo 24% prieaugį.

Šaltinis- tradingview

Šaltinis- tradingview

The Helium holders witnessed a steady downfall in August’s second half which plunged the altokinas price to a new 2022 low of $3.28. Moreover, the technical chart shows a descending trendline has provided dynamics3 resistance to these prices.

The multiple retests to this trendline indicate the traders are actively selling at this resistance. On September 11th, the coin chart showed a bearish reversal from the trendline and tumbled the price 29.3% lower to hit the $4 mark.

However, the buyers manage to rebound the price from this psychological support with a tweezer bottom candle. This bullish candle pattern indicates the altcoin obtained suitable footing to enforce further rally.

As a result, the Helium price showed an 8.3% recovery in the last two days. However, the volume activity decreasing indicates weakness in buyer commitment. Thus, with such scenarios, if altcoin hits the trendline, the prices will likely revert lower.

A potential bearish reversal could slump the Helium coin price below the $4 mark and revisit the bottom low support of $3.28.

On a contrary note, if the buyers manage to break this resistance, it will indicate the market sentiment has flipped from selling on rallies to buying on dips. This trendline breakout could offer a buying opportunity to interested traders.

Techninis rodiklis

Santykinio stiprumo indeksas: As RSI nuolydis is wavering below the midline, indicating the market sentiment is bearish.

EMA: the downsloping crucial EMAs(20, 50, 100, and 200) accentuate an overall downtrend and multiple resistance for a potential upswing. Moreover, the 20-day EMA aligned with the resistance trendline forms an additional barrier.

- Atsparumo lygiai - 5.7 ir 7 USD

- Palaikymo lygiai – 4 USD ir 3.33 XNUMX USD

Pateiktame turinyje gali būti asmeninė autoriaus nuomonė ir jis priklauso nuo rinkos sąlygų. Prieš investuodami į kriptovaliutas, atlikite rinkos tyrimus. Autorius ar leidinys neprisiima jokios atsakomybės už jūsų asmeninius finansinius nuostolius.

Source: https://coingape.com/markets/helium-coin-recovery-may-surge-15-before-the-next-bear-cycle/