- Curve Finance’s native token generated interest among whales

- The total value locked in the Curve protocol was more than Uniswap

Kreivės finansai [CRV] became a hot commodity among large addresses as the market focus shifted to decentralized exchanges (DEXes) after the FTX debacle. Pagal a WhaleStats tweet on 17 January, CRV became the most traded token among top „Ethereum“ [ETH] whales at press time, replacing the popular meme coin Shiba Inu [SHIB].

📰 TIK: USD CRV @curvefinance apversta $ SHIB už DAUGIAUSIAI PREKYDAMĄ žetoną tarp 500 geriausių #ETH banginiai

Peržiūrėkite 100 geriausių banginių čia: https://t.co/tgYTpOm5ws

(ir hodl $BBW norėdami pamatyti 500 geriausių duomenų!)#CRV #SHIB #banginiai #banginis kūdikis #BBW pic.twitter.com/N1E2Elkpjv

– WhaleStats (kripto banginių stebėjimas) (@WhaleStats) Sausis 17, 2023

skaityti Curve Finance [CRV] kainų prognozė 2023-24

Whales had collected CRV tokens verta $ 4,584 over the last 24 hours, which roughly translated to a movement of 5,200 tokens.

Additionally, a Twitter thread by Token Terminal nukreiptas out that the total number of CRV token holders expanded steadily and almost hit 90k, a jump of 12% since the FTX contagion hit the market. This is an interesting development in the context of traders’ diminishing confidence in centralized exchanges (CEXes).

👥 Historical tokenholder count for @CurveFinance pic.twitter.com/ylRMAW84zi

- Žetonų terminalas (@tokenterminal) Sausis 16, 2023

It’s a smooth ‘Curve’

The growing appeal of CRV was reflected in its price trajectory as well, which broke out of the $0.58-$0.5 range on 9 January to embark on a bull run, gaining almost 63%. It was chasing the important psychological level at $1.

The indicators reaffirmed the bullish narrative, as the Relative Strength Index (RSI) went high into the overbought territory. The On Balance Volume (OBV) too indicated that buying pressure was high as there was capital inflow into the market.

Curve Finance TVL shows promise

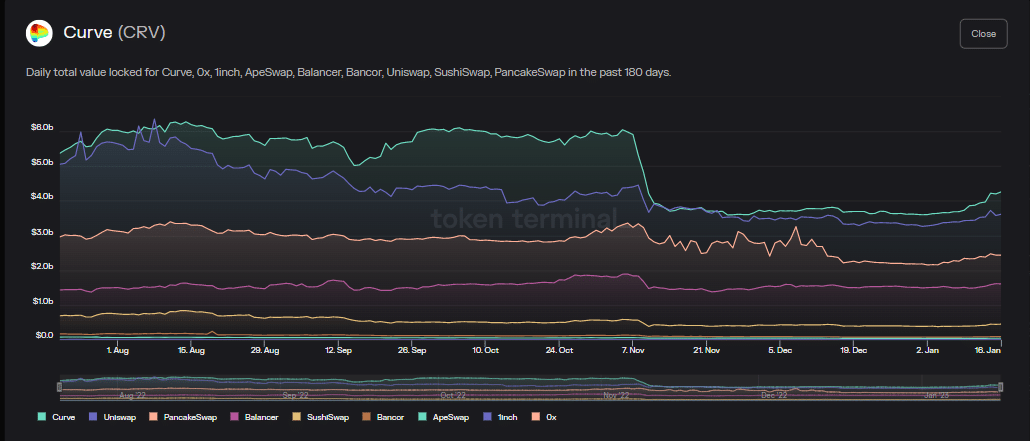

Among the DEXes, Curve Finance outperformed Ištrinti [UNI], the largest exchange by trading volume in terms of total value locked (TVL) in smart contracts. At the time of writing, Curve Finance’s TVL was estimated at $4.2 billion as per Token Terminal, an increase of over 11% over the past week as compared to a $6.84% growth rate showed by Uniswap.

An increase in TVL implied that investors had faith in the protocol, and more money was flowing through its network.

Ar jūsų portfelis žalias? Patikrinkite CRV pelno skaičiuoklė

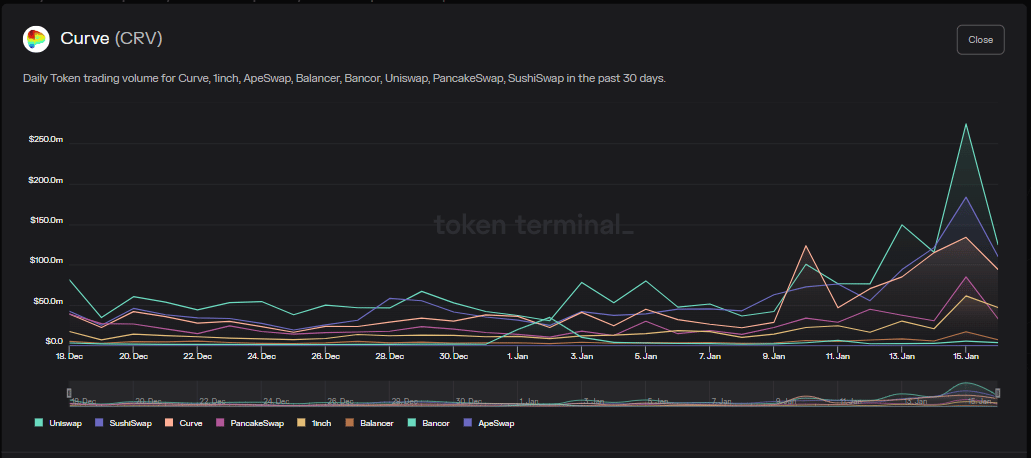

Furthermore, trading volume reached its monthly peak at almost $134 million. However, this number was significantly less than that of Uniswap and SushiSwap.

Unlike other automatic market makers (AMM), CRV’s liquidity pools mainly consist of similarly behaving assets like stabilias kainas, to evade the volatility that comes with other crypto assets. Hence, the growth of the stablecoin ecosystem, like the soon-to-be-launched Cardano’s Djedas, could power CRV’s growth going forward.

Source: https://ambcrypto.com/curve-finance-earns-approval-of-eth-whales-is-a-rally-incoming/