Ethereum Įrodymas-of-Work (ETHW) has bounced four times at the support line of the bullish pattern. As a result, a breakout from it seems to be the most likely scenario.

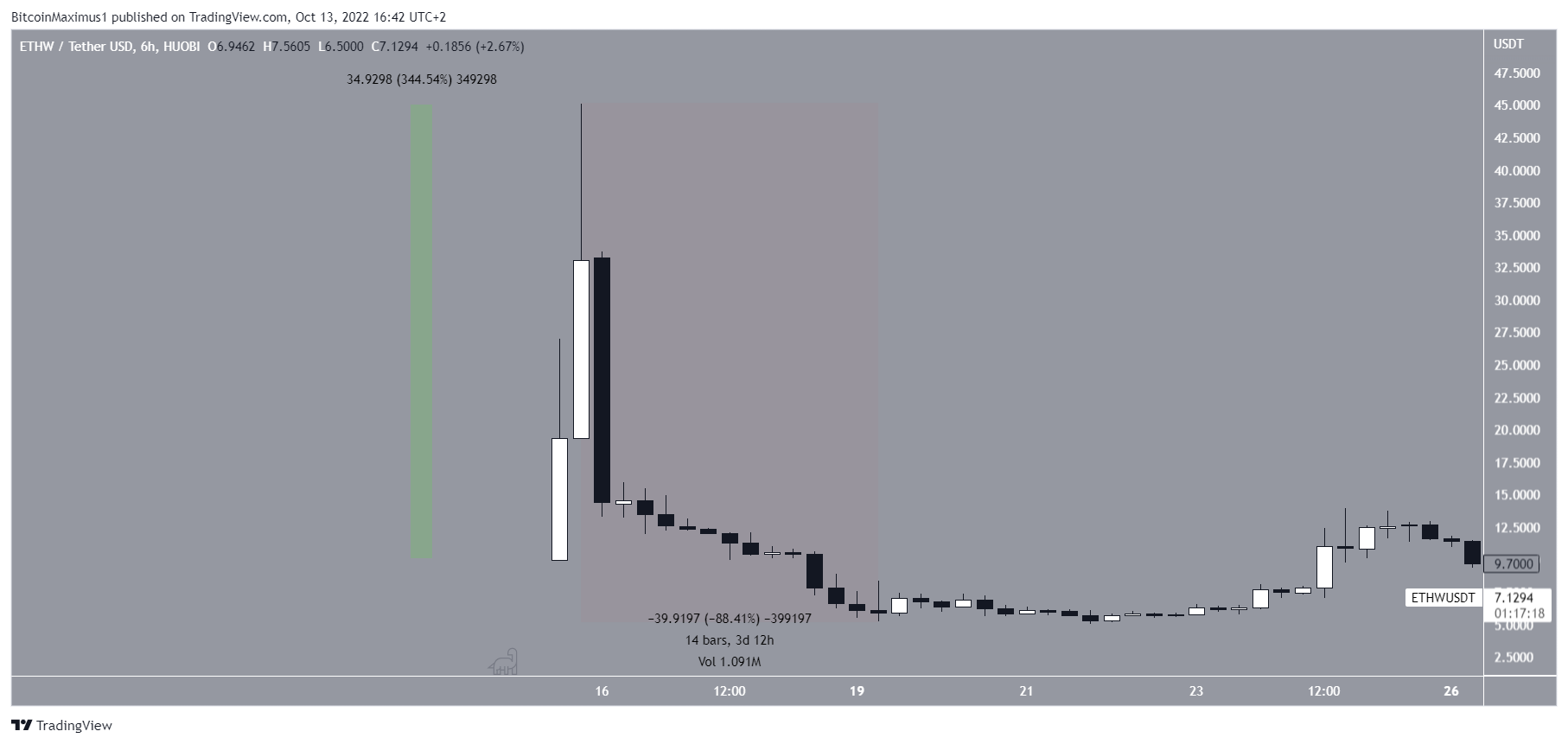

ETHW had a wild ride shortly after its launch. The price initially increased by a massive 344%, leading to a new all-time high of $45.10. However, the upward movement could not be sustained, and the price fell as quickly as it previously arose. In a span of three and a half days, ETHW fell by 88.40%, culminating with a low of $5.30 on Sept. 19. Interestingly, this was considerably below the listing price of $10.

Bullish ETHW pattern could lead to breakout

After the aforementioned low, ETHW initiated another upward movement which led to a high of $13.98 on Sept. 24 (red icon). However, the price has been falling since.

The entire decrease has so far been contained inside a descending wedge, which is considered a bullish pattern. Moreover, the price has bounced at the support line of this pattern several times, creating long lower wicks in the process. Finally, the six-hour RSI has generated a bullish divergence (green line) inside the oversold territory.

Despite these bullish readings, the price has broken down from $7.80, an area that previously provided support. Therefore, the area is now expected to provide resistance. Until ETHW moves above it, the trend cannot be considered bullish.

A movement above this area would also mean that ETHW has increased above the resistance line of the wedge, initiating the breakout.

In that case, the next closest resistance area would be at $11.15, created by the 0.618 Fib retracement resistance level.

Will the breakout materialize?

Due to the bullish pattern and bullish divergence in the RSI, a breakout from the wedge seems to be the most likely scenario. A movement above the $7.80 resistance area would confirm this possibility while a breakdown below the support line of the wedge would invalidate it.

Naujausiam „Be[In]Crypto“. Bitcoin (BTC) analizė, paspauskite čia

Atsakomybės apribojimas: „Be[in]Crypto“ siekia pateikti tikslią ir naujausią informaciją, tačiau ji nebus atsakinga už trūkstamus faktus ar netikslią informaciją. Jūs laikotės ir suprantate, kad bet kokią šią informaciją turėtumėte naudoti savo rizika. Kriptovaliutos yra labai nepastovus finansinis turtas, todėl tyrinėkite ir priimkite savo finansinius sprendimus.

Atsakomybės neigimas

Visa mūsų svetainėje esanti informacija skelbiama sąžiningai ir tik bendro pobūdžio informacijos tikslais. Bet kokie veiksmai, kuriuos skaitytojas imasi remdamasis mūsų svetainėje esančia informacija, yra griežtai jų pačių rizika.

Source: https://beincrypto.com/ethw-price-could-increase-by-50-percent/