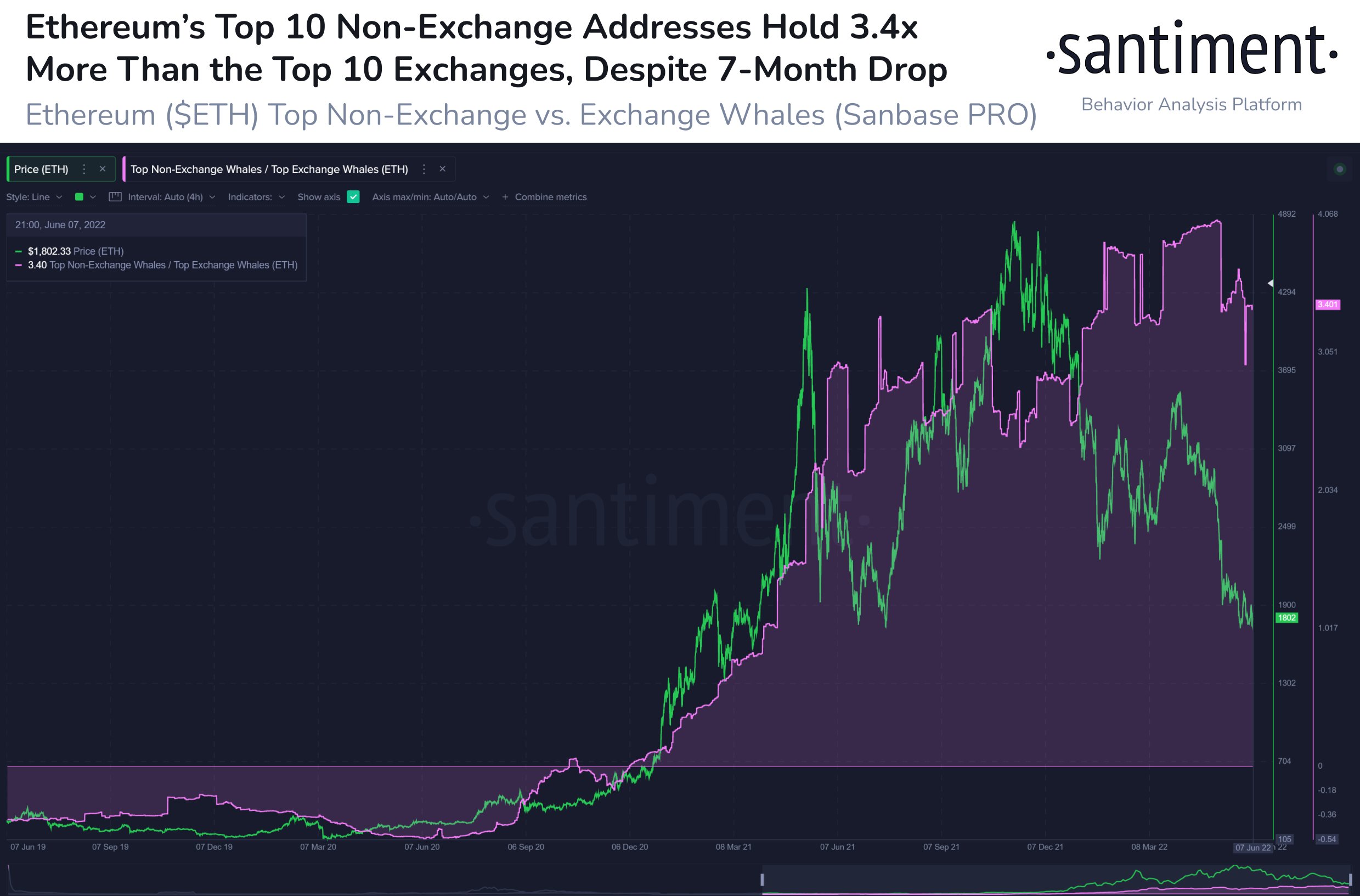

Analytics firm Santiment says the world’s most affluent crypto investors remain bullish on Ethereum (ETH) despite the downturn in the market.

According to Santiment, the top 10 non-exchange wallets maintain a high ratio of Ethereum in their portfolio and now hold 3.4 times more ETH than exchanges.

Įmonė sako this suggests the largest whales are keeping a firm grip on the leading altcoin.

Rašant, Ethereum keičia savininką už 1,778 USD.

“Ethereum’s top 10 non-exchange vs. exchange addresses are maintaining a high ratio of ETH owned over the top 10 non-exchange whales. With a tremendous 3.4x more coins held, there still appears to be a belief that prices can stabilize.”

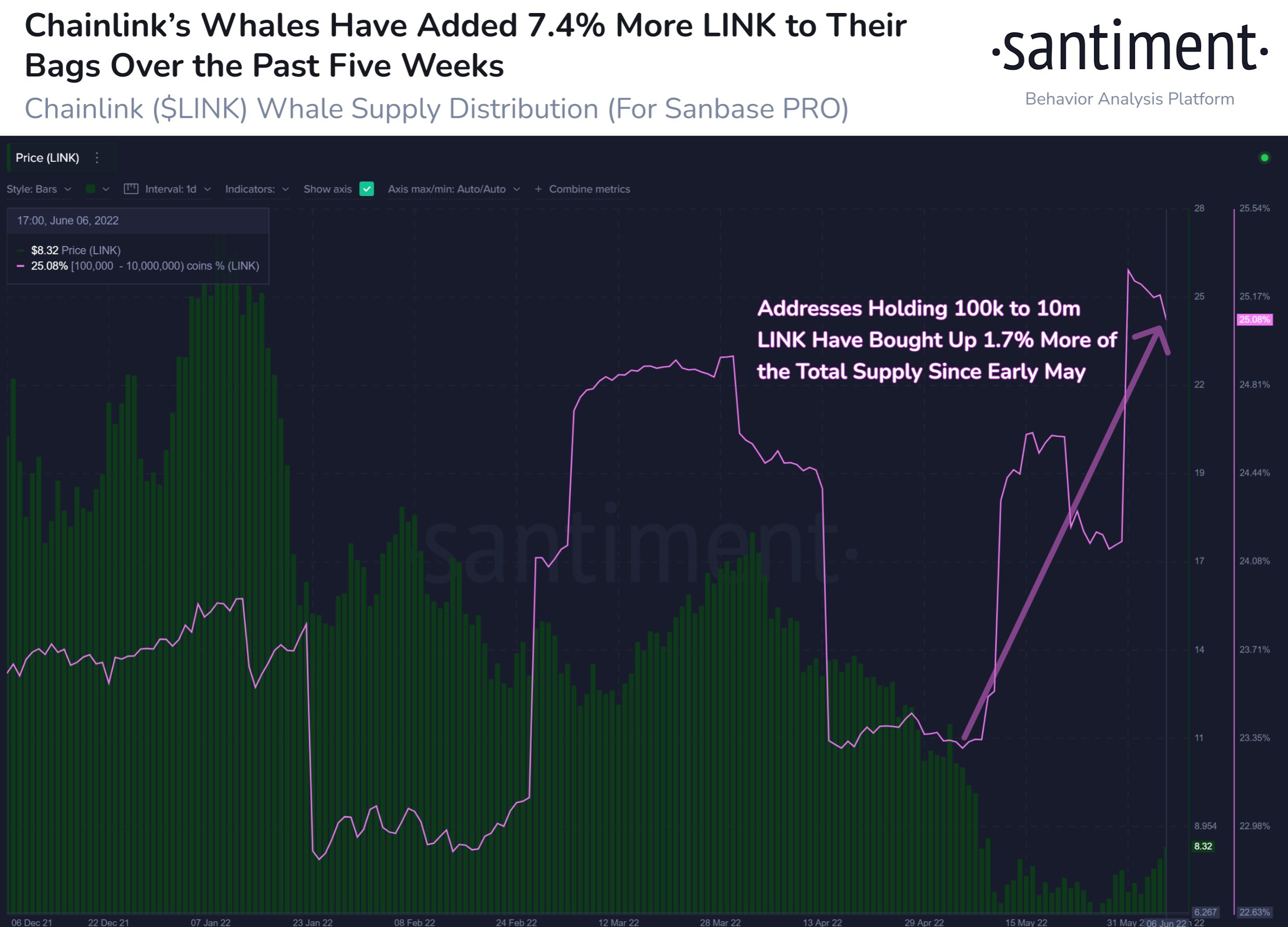

Santimentas taip pat sako deep-pocketed investors are accumulating Chainlink (LINK). The firm says whales have been stocking up the asset since last month when the price of the decentralized oracle network plunged to less than $6.00.

Rašant, Grandinės jungtis is trading for $9.35, up by 6.98% over the last 24 hours.

“Chainlink has pumped +9% in the past 2 hours, and accumulating whales are capitalizing. After dumping began on March 30th, they began accumulating again after prices dropped in early May. They hold 25%+ of the supply for the 1st time since November.”

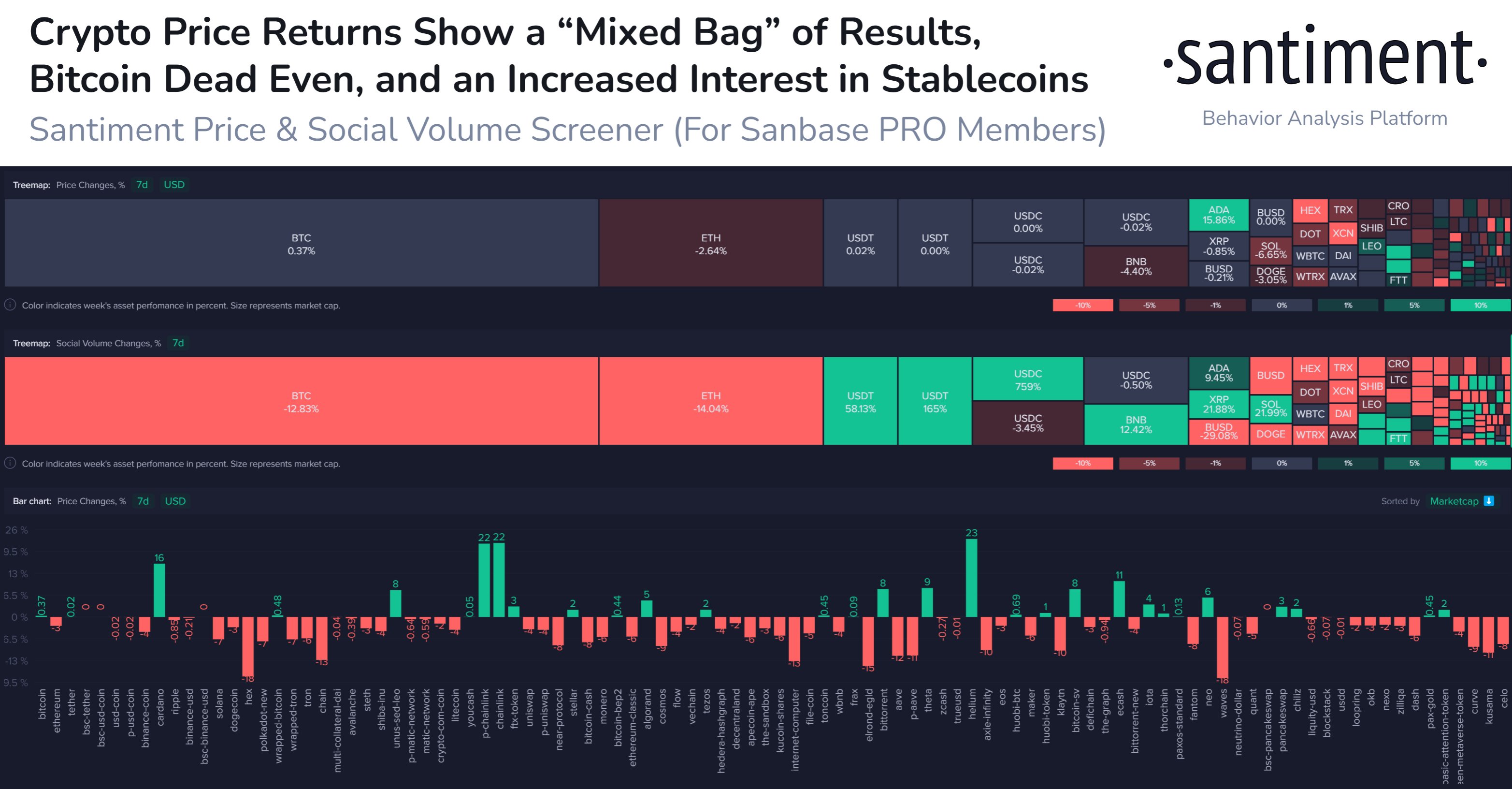

Analitikos įmonė sako LINK, along with Cardano (ADA) ir Helis (HNT), are performing well despite the high volatility of the crypto market in early June. Meanwhile, the prices of Bitcoin (BTC) and Ethereum are still moving sideways.

“Crypto prices chopped wildly in the opening week of June, but the result has been mainly no movement for Bitcoin and Ethereum. Altcoins, on the other hand, have shown major decouplings from one another, with ADA, LINK, and HNT performing well.”

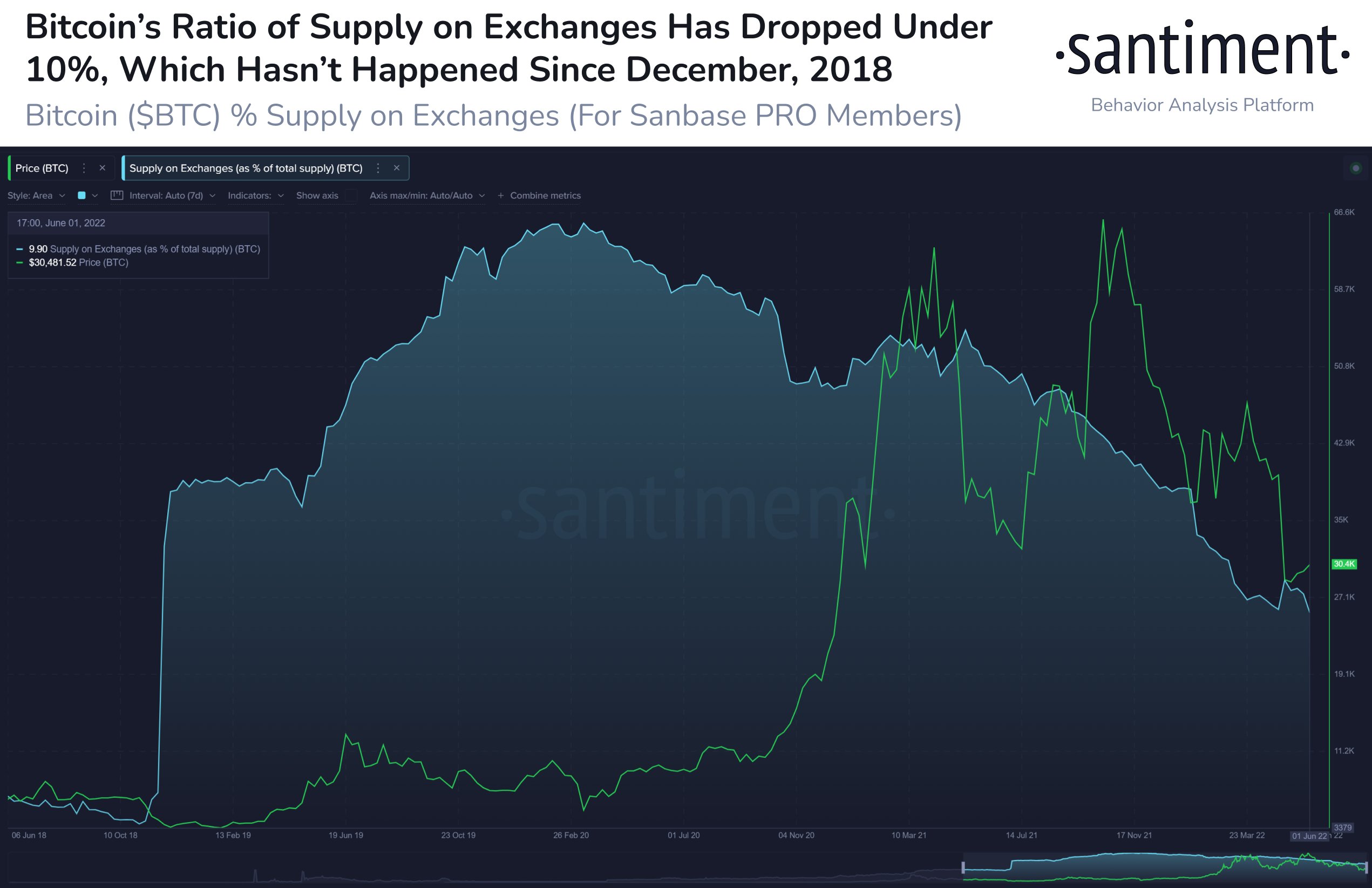

Santimentas taip pat atskleidžia the ratio of the Bitcoin’s supply on exchanges is now at 10%, the lowest since December 2018, which could be a sign of a bullish stance among long-term holders.

“The percentage of Bitcoin’s supply sitting on exchanges is down to 9.9% after May’s volatility caused an influx of BTC moving to exchanges for panic sells. This is a sign of hodler confidence, and exchange supply hasn’t been this low in 3.5 years.”

Tikrinti Kaina veiksmų

Nepraleisk ritmo - Prenumeruok kad kriptografiniai el. pašto įspėjimai būtų pristatyti tiesiai į jūsų gautuosius

Sekite mus Twitter, Facebook ir Telegram

Surf „Daily Hodl Mix“

Atsisakymas: „The Daily Hodl“ išsakytos nuomonės nėra patarimas dėl investavimo. Investuotojai turėtų atlikti deramą patikrinimą prieš imdamiesi bet kokių didelės rizikos investicijų į „Bitcoin“, kriptovaliutą ar skaitmeninį turtą. Informuojame, kad už savo pervedimus ir sandorius esate atsakingi patys, o už visus nuostolius, kuriuos galite patirti, esate atsakingas jūs. „Daily Hodl“ nerekomenduoja pirkti ar parduoti jokios kriptovaliutos ar skaitmeninio turto, taip pat „The Daily Hodl“ nėra patarėjas dėl investavimo. Atkreipkite dėmesį, kad „The Daily Hodl“ dalyvauja filialų rinkodaroje.

Bendras vaizdas: „Shutterstock“ / Tithi Luadthong

Source: https://dailyhodl.com/2022/06/10/top-crypto-whales-keep-a-firm-grip-on-ethereum-eth-while-accumulating-one-top-25-altcoin-analytics-firm/