Uncertainty is lingering for investors following a recent mixed batch of data — softer-than-expected inflation, stronger-than-anticipated jobs and wages — as we kick off the third week before Christmas.

That’s as we wind down a year that just hasn’t been great for most investors at all. Feeling your pain a bit is Hussman Investment Trust president and long-time bear in residence, John Hussman, who says investors are facing a “trap door” type situation with stocks right now.

The manager says he’s finding it hard to get constructive on these “overvalued markets with ragged and divergent internals” — conditions that he notes were seen at 2000, 2007, and 2020 market peaks.

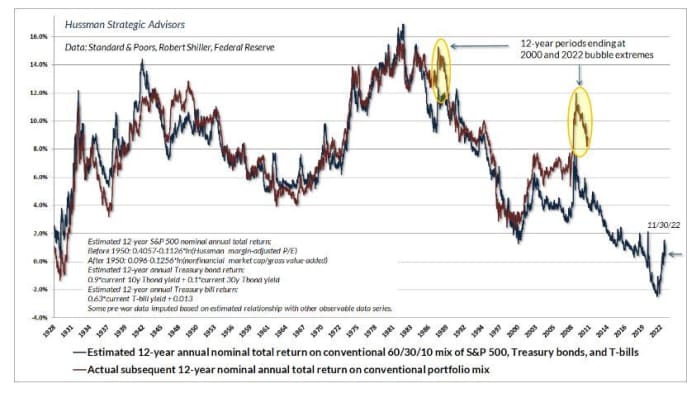

“Year-to-date market losses have retraced the frothiest segment of the recent speculative bubble, yet valuations remain at levels that we continue to associate with negative expected S&P 500

SPX

nominal total returns over the coming 10-12 year period,” Hussman wrote in a recent note to clients.

As of Nov. 30, he says the S&P 500’s total return is down less than 15% from the most extreme historic levels of stock market valuations, based on a century of market cycles.

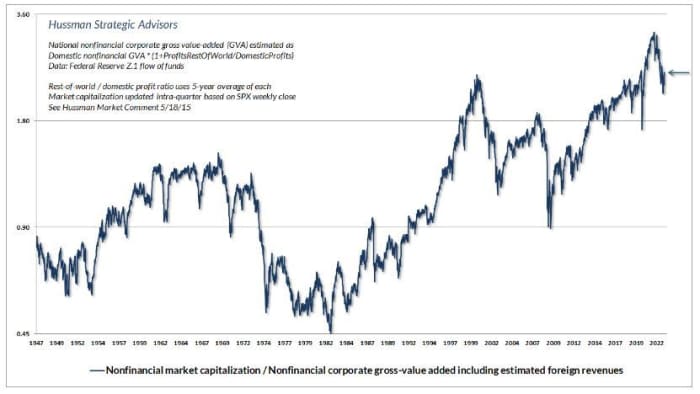

His chart below is the money manager’s “most reliable valuation measure, based on its correlation with actual subsequent S&P 500 total returns in market cycles across history: the ratio of U.S. nonfinancial market capitalization to gross value-added (MarketCap/GVA). ” In short, valuations are still fairly nose-bleedy:

Hussman fondai

That’s even as they’ve come off the extreme levels seen at the beginning of 2022 when interest rates were at zero, he said. Hikes since then mean yield-seeking speculation has pared back, leaving the “equity market at speculative valuations, but without the support of speculative pressures,” said Hussman.

Ką tai reiškia?

“In our view, steep market losses generally reflect risk-aversion meeting a low-risk premium. As a result, we continue to describe market conditions, particularly in equities as a ‘trap door’ situation,” he writes. He’s fully or nearly fully hedged across their three main funds.

“As always, we believe that the strongest return/risk profile for stocks emerges when a material retreat in valuations is joined by a shift to uniformly favorable market internals. We’ve observed such a shift after every bear market decline since I introduced our key measure of internals in 1998, as well as in a century of historical data,” he said.

And of course, the raggedy internals seen presently mean that shift is not here yet.

“We continue to believe that a value-conscious, risk-managed, full-cycle discipline, focused on the combination of valuations and market internals, will be essential in navigating market volatility in the years ahead,” said Hussman.

Over the long run, investors will be challenged indeed, he finds.

His below chart shows their estimate of how returns could look over 12 years in a conventional passive portfolio mix invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills. That red line shows actual subsequent 12-year returns for this same portfolio mix.

Hussman

Hussman does have about 10% in precious metals in its Strategic Total Return Fund

HSTRX,

“Historically, precious metals shares have performed far better in periods when bond yields are declining (in general, below their level of 6-months earlier) than when they are advancing,” he said, adding that dollar weakness is also helping.

Nuomonė: There’s a strong possibility that the bear market in stocks is over as investors have given up hope

Rinkos

MarketWatch

Atsargos

DJIA,

COMP,

are lower for Monday, as Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

climb and the dollar

DXY,

drops. Crude prices

CL.1,

are surging after OPEC + left production levels unchanged and a $60 per barrel Russian price limit agreed by the EU and G-7 kicks in.

Norėdami gauti daugiau rinkos naujienų ir realių akcijų, opcionų ir kriptovaliutų prekybos idėjų, užsiprenumeruokite „MarketDiem“, „Investor's Business Daily“..

Šurmulys

Honkongo akcijų

HSI,

soared 4% after Beijing and more than a dozen other Chinese cities eased some testing requirements over the weekend, with Guangzhou and other industrial cities reopening. A swath of China ADRS are also soaring — Alibaba

BABA,

Pinduoduo

PDD,

ir Baidu

BIDU,

pavadinimas kelias.

Tesla

TSLA,

turi neigė pranešimus it will voluntarily cut car production in Shanghai for the first time owing to weaker Chinese demand.

Special purpose acquisition company Concord Acquisition

CNDB,

said its deal to buy stablecoin issuer Circle Internet Financial has collapsed.

"Credit Suisse"

CS,

shares rallied on a report Saudi Arabia’s crown price wants to invest in an investment bank spinoff.

The Institute for Supply Management’s service index and factory orders are Monday’s highlights in a relatively data-light week.

Geriausia žiniatinklio dalis

Farmers and scientists have developed heat-resistant wheat crops.

Iranas turi shut down its “morality police,” blamed for the death of a woman that triggered months of protests

Lentelė

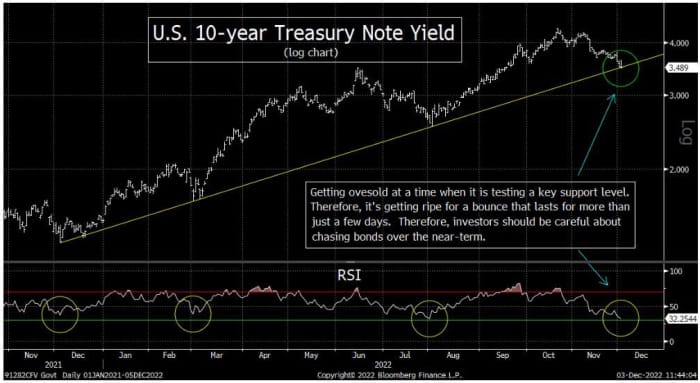

Investors chasing bond prices higher in the near term should tread carefully, according to this chart from Matt Maley, Miller + Tabak.’s chief market strategist, in a weekend note to clients.

He said they warned in early October that the yield on the 10-year Treasury note

TMUBMUSD10Y,

and the 2-year Treasury note

TMUBMUSD02Y,

were becoming very overbought (oversold on price) and ripe for a big pullback, which subsequently happen, bringing yields down significantly.

“Therefore, we believe investors should be careful about chasing bonds right now (Treasury bonds or otherwise) over the near-term. You could/should be able to get better prices later this month and/or early in the new year,” said Maley.

Miller +Tabak

Tikeriai

„MarketWatch“ 6 val. ryto buvo dažniausiai ieškoma šių žymenų:

| Akcija | Apsaugos pavadinimas |

| TSLA, | Tesla |

| BERNIUKAS, | NIO |

| GME, | GameStop |

| CMA, | AMC pramogos |

| AAPL, | Apple |

| COSM, | Cosmos Holdings |

| BABA, | Alibaba |

| XPEV, | XPeng |

| AMZN, | Amazon.com |

| MULN, | Mullen Automobiliai |

Atsitiktinis skaitymas

Couple pay for Spanish holiday by renting out their driveway

A single straw leads police to a bank robber in Massachusetts

“Goblin mode” is Oxford Dictionary’s word of 2022

„Reikia žinoti“ pradedama anksti ir atnaujinama iki atidarymo skambučio, bet užsiregistruoti čia kad jis būtų pristatytas vieną kartą į jūsų el. pašto dėžutę. El. Paštu atsiųsta versija bus išsiųsta apie 7 val. Ryto.

Klausykite Geriausios naujos pinigų idėjos podcast'as su MarketWatch reporteriu Charlesu Passy ir ekonomiste Stephanie Kelton

Source: https://www.marketwatch.com/story/this-long-time-bear-warns-of-a-trapdoor-situation-looming-for-the-stock-market-11670241965?siteid=yhoof2&yptr=yahoo