TL; DR suskirstymas

- Uniswap price analysis suggests an upward movement to the $7.50 mark

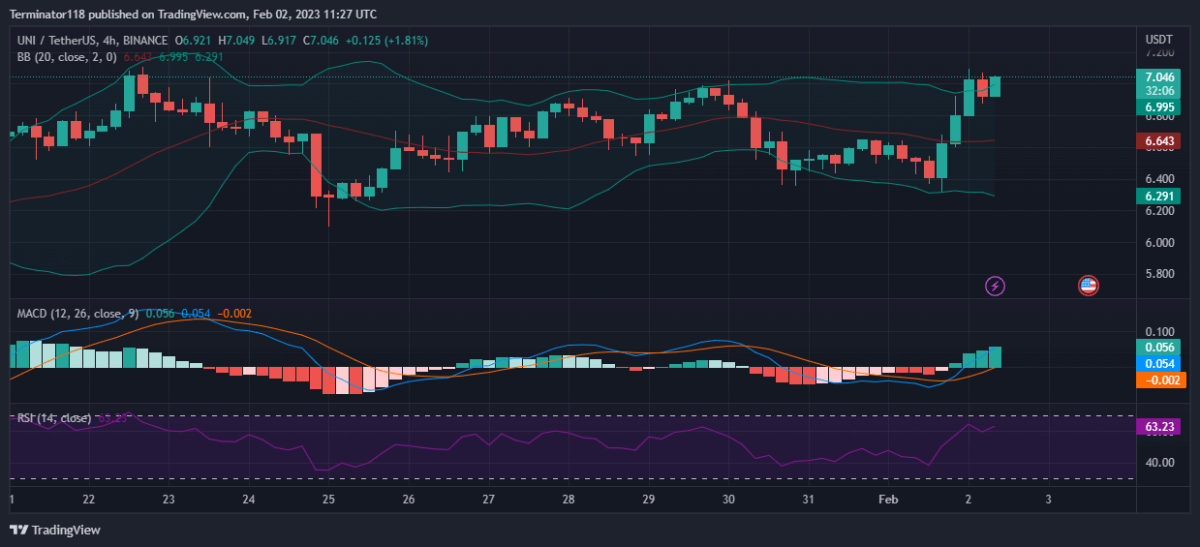

- Artimiausias palaikymo lygis siekia 6.291 USD

- UNI susiduria su pasipriešinimu ties 7.046 USD riba

Šios Pašalinti kainą analysis shows that the UNI price action has broken above the $7.00 mark as the bulls continue the rally.

The broader cryptocurrency market observed a bullish market sentiment over the last 24 hours as most major cryptocurrencies recorded positive price movements. Major players include BNB and ETH recording a 5.90 and a 5.53 percent incline, respectively.

Uniswap kainos analizė: UNI viršija 7.00 USD ribą

MACD šiuo metu yra meškų, kaip išreikšta raudona histogramos spalva. Tačiau indikatorius rodo mažą kritimo momentą, išreikštą trumpu rodiklio aukščiu. Kita vertus, tamsesnis indikatoriaus atspalvis rodo didėjantį meškų aktyvumą, kai kaina artėja prie 0.3800 USD ribos.

EMA šiuo metu prekiauja virš vidutinės pozicijos, nes grynasis kainų pokytis per pastarąsias dešimt dienų išlieka teigiamas. Šiuo metu EMA prekiauja arti viena kitos ir spaudos metu rodo mažą pagreitį. Kita vertus, besiskiriančios EMA rodo sparčiai didėjantį bulių tempą.

Pastarąsias dešimt dienų RSI prekiavo neutraliame regione, nes per visą laikotarpį buvo pastebėtas nedidelis turto nepastovumas. Spaudos metu rodiklis prekiauja žemiau vidutinės linijos ties 45.56 indekso vieneto lygiu, nes kaina rodo mažą kritimo impulsą su švelniu nuolydžiu, o tai rodo mažą grynojo pardavimo aktyvumą esant dabartiniam kainų lygiui.

The Bollinger Bands are currently ideal as the price action observed high volatility across the short-term charts. Moreover, the sharp bullish activity near the indicator’s top line suggests increasing volatility across the timeframe. The indicator’s bottom line provides support at the $6.291 mark while the bottom line presents a resistance level at the $7.046 mark.

Techninės UNI/USDT analizės

Overall, the 4-hour Uniswap price analysis issues a buy signal, with 15 of the 26 major technical indicators supporting the bulls. On the other hand, two of the indicators support the bears showing low bearish presence in recent hours. At the same time, nine indicators sit on the fence and support neither side of the market.

The 24-hour Uniswap price analysis shares this sentiment and also issues a strong buy signal with 15 indicators suggesting an upwards movement against one suggesting a downward movement. The analysis shows strong bullish dominance across the mid-term charts with low bearish resistance persisting. Meanwhile, the remaining ten indicators remain neutral and do not issue any signals at press time.

Ko tikėtis iš Uniswap kainų analizės?

The Uniswap price analysis shows that the Uniswap market is enjoying a strong bullish rally as the price rose from $5.00 to the current $7.000 in the last 30 days. Currently, the price finds strong resistance at the $7.000 level but the rising bullish momentum may establish support above the level.

Traders should expect UNI to rise to the $7.500 mark as the short-term technicals grow more bullish. On the other hand, movement below $6.500 should not be expected as the daily frames and the mid-term technical analyses remain bullish. However, if the bulls fail to set up a support level above the $7.00 mark, the price would continue consolidating below the $7.00 mark.

Šaltinis: https://www.cryptopolitan.com/uniswap-price-analysis-2023-02-02/