Following a series of enhancements in its liquidity and technology solutions, B2Broker, a leading liquidity provider for the global trading industry, has just launched a new set of institutional liquidity offer sąlygos.

There are significant reductions in volume fees and significantly lowered entry barriers under the new commercials.

In the announcement, the new deal is intended to provide brokers with even more opportunities to grow their business and benefit from a competitive edge while keeping their costs as low as possible.

Lower liquidity fees for brokers

The following is a list of markets where volume fees changes were made by B2Broker in response to industry needs pot FX, metals, indices, energies and commodities.

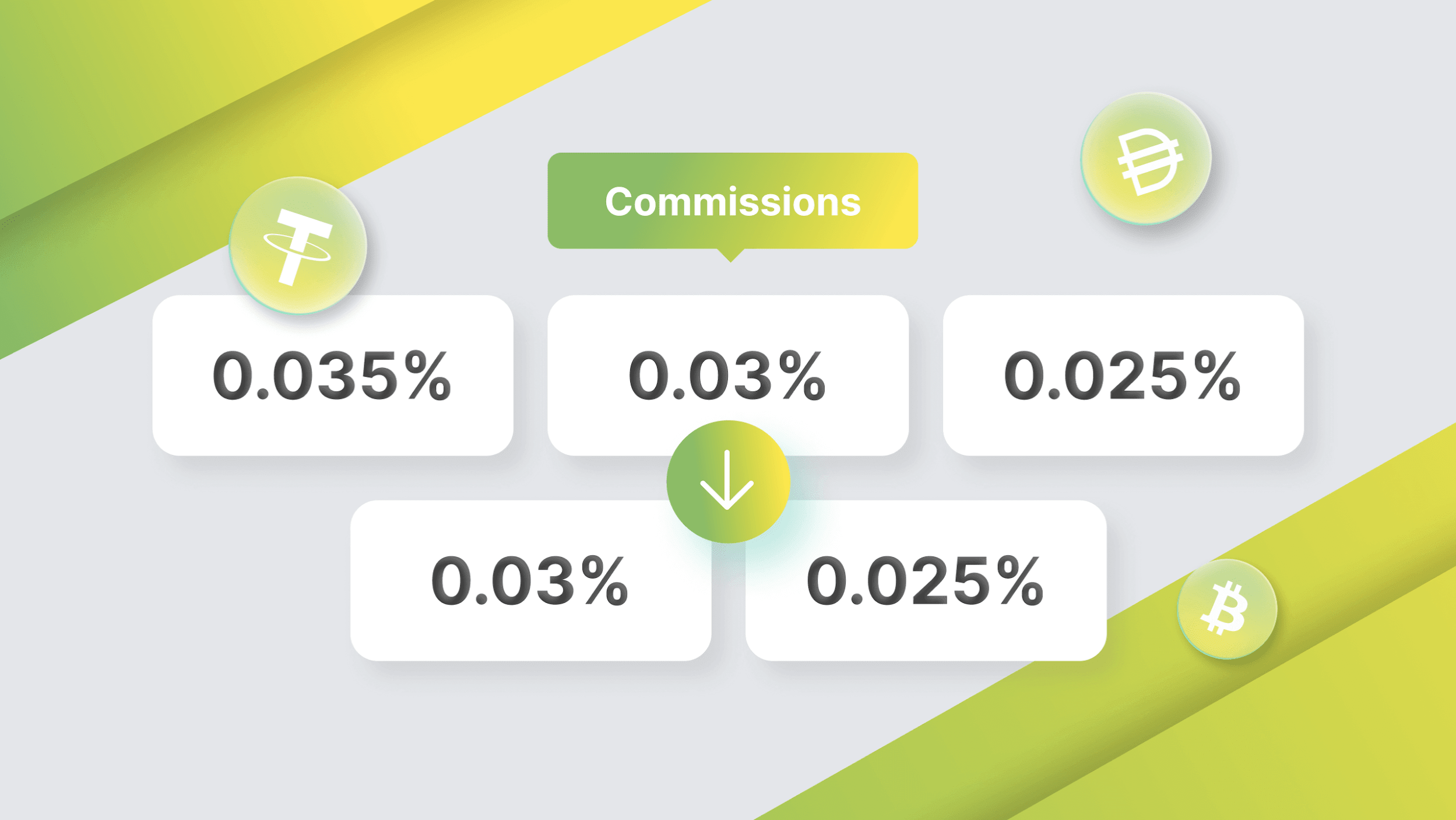

Enhanced crypto liquidity fee structure for brokers

Additionally, B2Broker has taken measures to minimize the liquidity volume fees for its market-leading crypto CFDs, lowering the first level of the ladder from 0.035% to 0.03% and below.

Lessened minimum monthly commission

Getting business done with B2Broker on a monthly basis has become even more alluring. There is now a $1,000 minimum fee instead of $1,250.

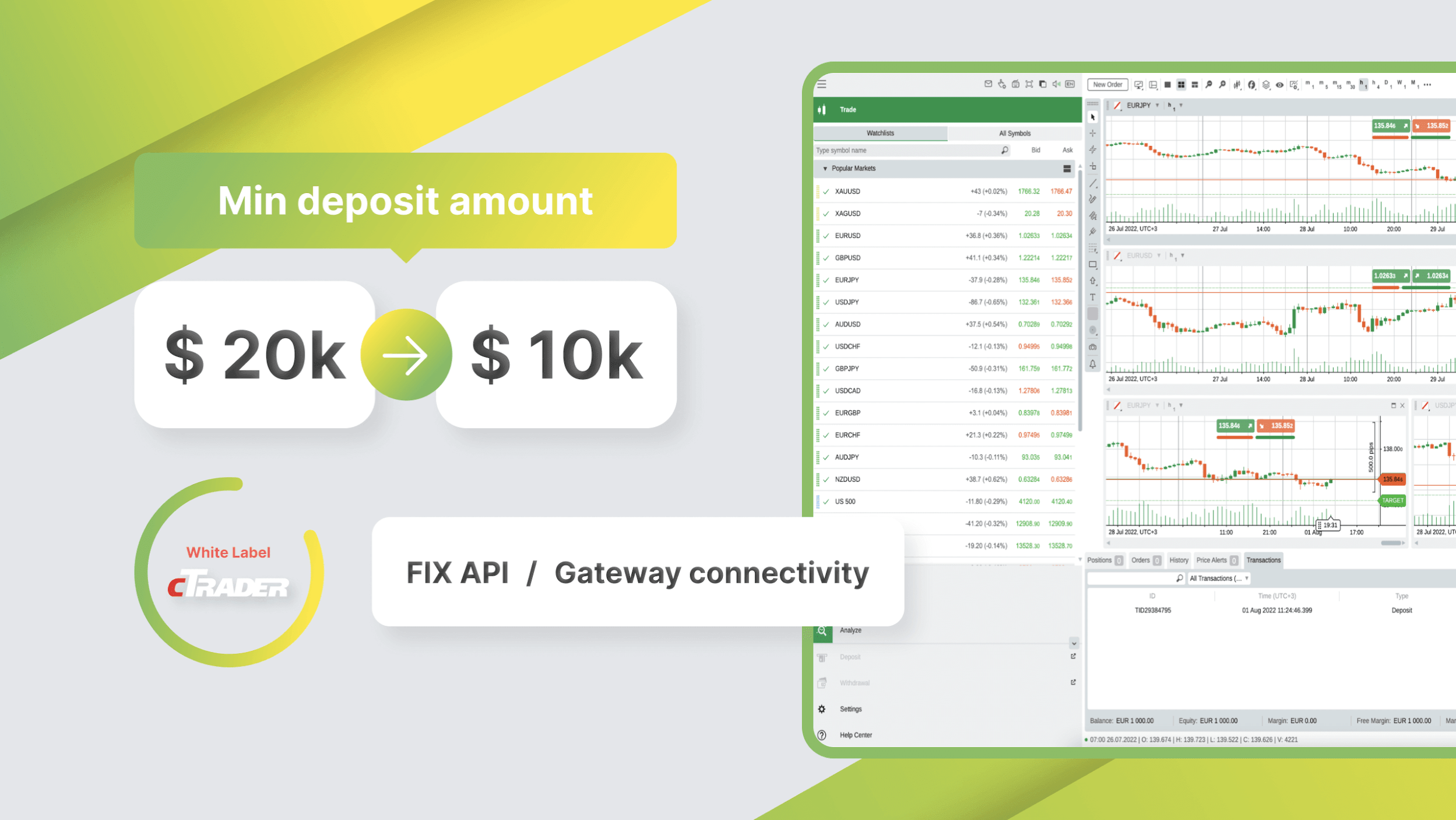

Entry deposit amount cut by 50%

With the minimal deposit amount reduced by 50% nuo $ 20,000 iki $ 10,000 prospective brokers have a lower entry barrier than ever before.

Išvada

An upgrade to B2Broker’s institutional liquidity offers an unrivaled mix of solution abundance and unheard-of cost effectiveness all with the security of a reliable technology and liquidity provider.

The new solution was made with a reduced fee schedule on five key asset classes, new minimum monthly costs for brokers, lower deposit requirements and lower liquidity volume fees for Crypto CFDs in mind to help your company grow.

Šis turinys remiamas ir turėtų būti laikomas reklamine medžiaga. Čia išsakytos nuomonės ir teiginiai yra autoriaus nuomonės ir neatspindi „The Daily Hodl“ nuomonės. „Daily Hodl“ nėra dukterinė įmonė arba nepriklauso jokioms ICO, „blockchain“ pradedančioms įmonėms ar įmonėms, kurios reklamuojasi mūsų platformoje. Investuotojai prieš atlikdami bet kokias didelės rizikos investicijas į bet kokius ICO, „blockchain“ startuolius ar kriptovaliutas, turėtų atlikti tinkamą patikrinimą. Primename, kad už savo investicijas jūs esate atsakingi patys, o už galimus nuostolius esate atsakingi jūs.

Sekite mus Twitter Facebook Telegram

Source: https://dailyhodl.com/2022/12/15/b2broker-updates-its-institutional-liquidity-offer-for-brokers/