Prisijunkite prie mūsų Telegram kanalą, kad gautumėte naujausią informaciją apie naujausias naujienas

Binance Coin (BNB) was the only top 10-ranked crypto leading price drops on Tuesday as investors struggled to shake off Binance “FUD” that has been running in the market over the past few days. The market is also waiting for inflation data and the last United State Federal Reserve meeting of the year 2022 is scheduled for later this week.

Binance Coin price is trading just below $270, down 5.48% on the day, according to data from CoinMarketCap. BNB is trading in a third straight bearish session having lost 9% since Sunday open. This is accompanied by a trading volume of $1.6 billion which has increased by over 180% in the past 24 hours, suggesting increased investor activity mostly directed toward selling the coin. Its live market cap now stands at $42,617,317,465, also down 5.48% in the past 24 hours.

Reasons Why Binance Coin May Drop Further

After oscillating around the 100-day simple moving average (SMA) at the end of last week, BNB eventually dropped below the moving average on Sunday. The ensuing sell-off saw the BNB/USD pair lose the support at the $280 psychological level and the 200-day SMA which sat at $278.

The price sank on the news that Binance, the company behind BNB, was reportedly facing charges of non-compliance with the U.S. Anti-Money Laundering (AML) laws. According to a "Reuters" pranešti, the U.S. The Department of Justice (DoJ) was split on whether to charge the world’s largest crypto exchange and its Chief Executive Officer (CEO), Changepeng Zhao, following 2018 AML investigations.

Adding to the headwinds are fresh concerns about Binance’s proof-of-reserves (PoR), with several questions raised about the exchange’s corporate structure, internal quality control, and Bitcoin liabilities. According to accounting and financial specialists konsultavosi by „The Wall Street Journal“ (WSJ), the audit report released by Mazar did little to boost investor confidence in Binance’s financial health as information on the quality of internal controls and how the exchange liquidates assets to cover margin loans was lacking.

Another issue pointed out by the WSJ’s consultants regards the Zhao-led firm’s corporate structure. According to the report, Patrick Hillmann, the trading platform’s chief strategy officer was unable to give information about Binance’s parent company, as the firm has been going through corporate reorganization over the last two years.

According to the PoR report released by the audit firm Mazars on December 7, Binance controls over 575,742.42 Bitcoin belonging to its customers, worth $9.7 billion at the time of the report. This means that “Binance was 101% collateralized”, said the company. This finding was debunked by the WSJ results which highlighted differences between the total Bitcoin liabilities.

Instead, the investigation found that the exchange was 97% collateralized excluding assets lent to users through loans or margin accounts, indicating that the 1:1 ratio of reserves to customer assets was not achieved. They poked holes into Marzars’s report saying:

„Nustatėme, kad „Binance“ buvo užstatas 97 proc., neatsižvelgdami į klientų, kurie buvo įkeisti neperžengiamuoju turtu, kaip užstatą už neribotą turtą, paskolintą per maržos ir paskolų paslaugų pasiūlymą, todėl Kliento įsipareigojimų ataskaitoje susidaro neigiami likučiai. Įtraukę klientams per maržą paskolintą turtą ir paskolas, kurios yra per didelės užstatu nepatenkamais turtais, nustatėme, kad Binance buvo užstatas 101 proc.

This has raised investor concerns which various commentators have labeled as FUD aimed at bringing the crypto giant down.

#Binansas is getting targeted by ridiculous fud led by paid media and fud twitter accounts.

aš tikiu @SBF_FTX yra už jo.

Aš pirksiu daugiau USD BNB as these news are just empty words from bad actors.#crypto pic.twitter.com/fC1SuHzVNq— Carlo Kenolol ⚡🐳 (@CKenolol) Gruodis 13, 2022

BNB price is also set to drop further as traders are still afraid of the upcoming macro data and legal events tied to the FTX/SBF/Alameda fiasco. The November Consumer Price Index (CPI) data due on December 13 is expected to be a pivotal moment for cryptocurrencies with the potential for significant upside and downside hinging on the numbers. Economists widely expect the Fed to raise interest rates by 50 basis points when its two-day meeting concludes Wednesday.

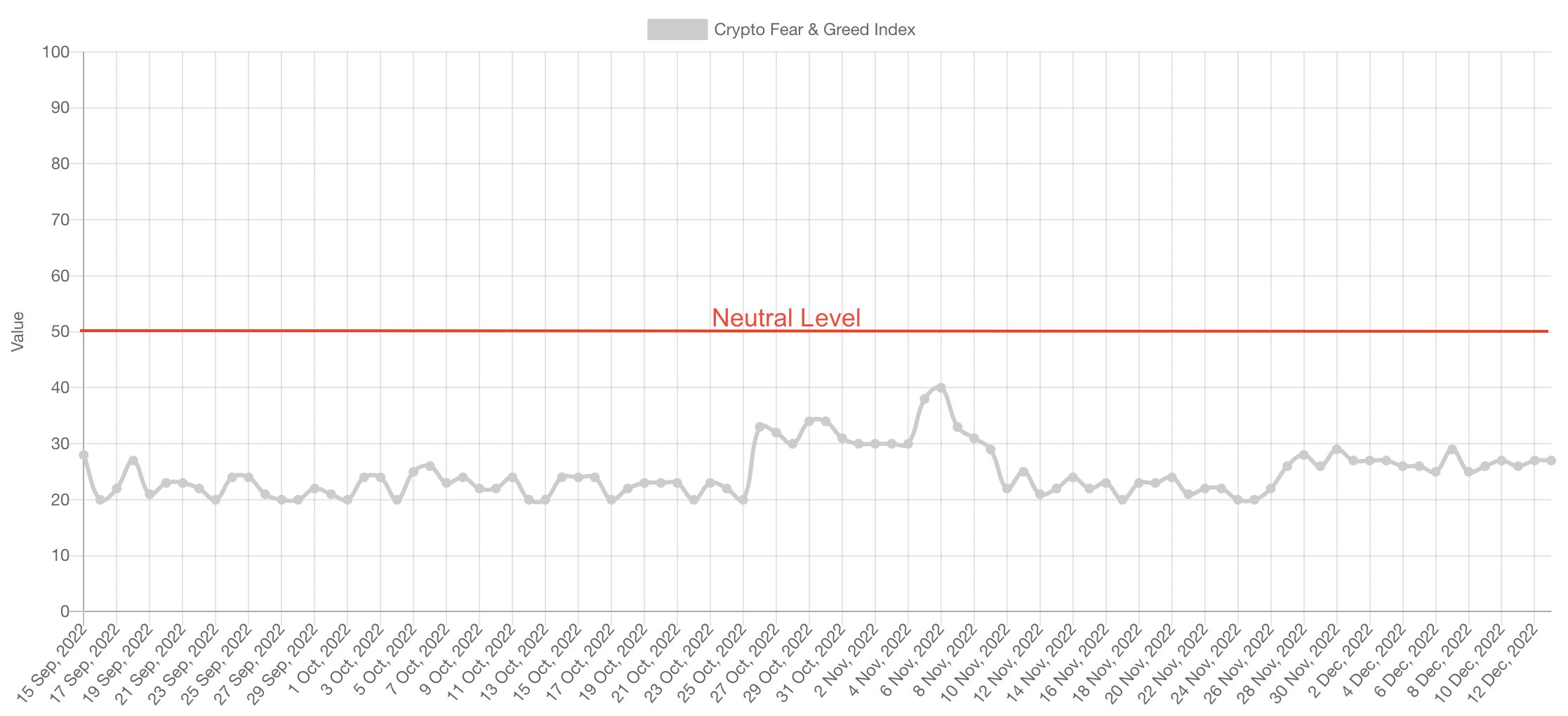

The crypto market sentiment remained weak according to the Crypto Fear & Greed Index, which currently stands at 27 on the day – still below the neutral zone.

Crypto Fear And Greed Chart

Binance Price Bears Eye A Revisit Of $240

At press time, BNB price traded below a descending parallel channel, adding to bearish sentiments for the exchange token. The Relative Strength Index (RSI) was facing downward and the price strength at 39 reinforced the sellers’ grip on BNB. The Moving average convergence Divergence (MACD) indicator was also moving downward away from the zero line, suggesting that the price action favored the downside.

As such, if the current sell-off continues, Binance Coin price may drop further from the current levels to revisit Tuesday’s swing-low at $255. In highly bearish cases, the Binance Coin may decline further to seek solace from the $250 psychological level or drop lower to tag the November 23 swing low around $240. Such a move would represent a 10% descent from the current price.

BNB/USD dienos diagrama

On the upside, the BNB price was required to close the day above the immediate resistance at $275, embraced by the lower boundary of the descending channel. If this happens, the Binance Coin price bulls will be bolstered to push the price higher reclaiming key support levels such as the 200-day SMA currently sitting at $277, the middle boundary of the channel at $281, the 100-day SMA at 286 and the upper boundary at $287.

Overcoming this stubborn supply zone could clear the way for a run-up to the 50-day SMA at $295 or higher toward the $310 range high. This would bring the total gains to 15%.

New Tokens With Promising Returns As 2022 Ends

With the greater crypto market still struggling to recover from the FTX disaster and the uncertainties around the macro environment, it may be a good time to explore buying at lower prices other altcoins that haven’t pumped recently or investuoti į mažesnės kapitalizacijos projektus išankstiniame išpardavime.

Yra nemažai projektų, kurie jau surinko nemažą sumą iš anksto parduodant kapitalą ir yra pasirengę augti ateityje. „Dash 2 Trade“ (D2T) ir „Calvaria“ (RIA) yra keletas naujų žetonų, šiuo metu parduodamų prieš pardavimą, žadantys grąžą, kai artimiausiu metu bus įtraukti į biržos sąrašus.

Dash 2 Trade (D2T)

Dash 2 Prekyba is a decentralized exchange (DEX) built on the Ethereum blockchain that is set for launch early next year. The team behind D2T has so far raised $9.6 million with over 99.79% of tokens in stage 3 of the presale sold. In the fourth and final stage of the presale (which is set to start in the near future), the D2T price will rise to $0.0533. It would be good to invest in the token now before the price increases. The D2T development team is ahead of schedule making it possible to launch the presale dashboard sooner than earlier planned.

Kalvarija (RIA)

Kalvarija is a blockchain-based card-trading game enabling players to battle with their NFT cards and earn rewards. RIA, the platform’s native token is currently in the last stage of the presale with over $2.4 million raised and only 22% of tokens left.

Plačiau paskaitykite čia:

Dash 2 Trade – didelio potencialo išankstinis pardavimas

- Aktyvus išankstinis pardavimas tiesiogiai dabar – dash2trade.com

- „Cointelegraph“ – surinkta 10 mln. USD

- KYC patikrinta ir audituota

- Vietinis kriptovaliutų signalų ekosistemos ženklas

Prisijunkite prie mūsų Telegram kanalą, kad gautumėte naujausią informaciją apie naujausias naujienas

Source: https://insidebitcoins.com/news/binance-coin-price-analysis-bnb-risks-further-retracement-to-240