Dogecoin (DOGE) gauta kaina Nenuostabu bulių impulsas, appreciating by over 12% in the last day, trading at $0.09064. High trade volumes supported the price pump as 24-hour volumes surged by 41.60%.

Apart from high trade volumes, though, there were other reasons behind the recent DOGE kainos siurblys. Seemingly the price pump stemmed from a bullish perpetual market. However, the crucial question remained whether this bullish momentum would sustain and for how long.

Dogecoin Perpetual Market Flourishes

Dogecoin open interest saw a sudden 30.11% rise and stood at $292.6 million at press time. Positive changes in the Dogecoin perpetual market could play a key role in its short-term price appreciation.

Alongside spiking open interest, DOGE funding rate was in positive territory. With open interest rising, the funding rate positive, and price action green, the same signaled towards incoming bullish price action.

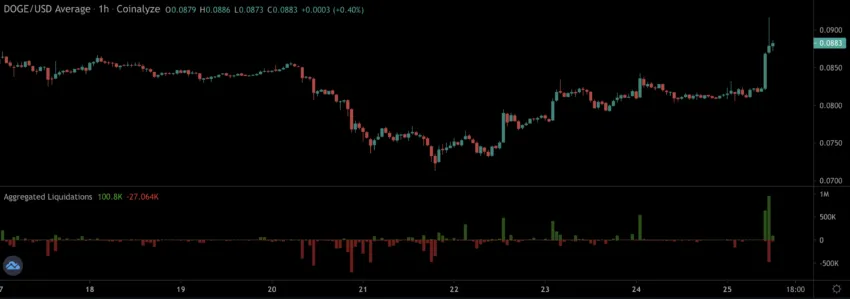

Furthermore, short liquidations on Binance worth over $1.2 million supported the short-term bullish price action DOGE saw.

Around $2.4 million in liquidations took place in the DOGE market, with $1.8 million in short liquidations and $694,000 long liquidations.

While Dogecoin had a glimmering spot and ateities price action, on-chain metrics for the coin didn’t necessarily glow.

Wave of Price Volatility for DOGE

Dogecoin nepastovumas was at all-time high yearly levels. A major uptick in volatility usually leads to significant price swings in either direction. At press time, DOGE volatility was around 206%, a level last seen in May 2021.

Dogecoin Daily Active Addresses had been declining for some time. Seven-day active addresses fell by 20.22%, while new addresses dropped by 8.67%. In addition to that, DOGE banginiai have maintained a cautious stance.

After the FTX fall, the largest whale cohort with 10 million to infinity coins reduced their holdings by close to one billion DOGE.

All in all, it seemed like DOGE price could be undergoing a typical Friday pump which often results in weekend losses. With volatility at yearly high levels, price movement in either direction could be expected.

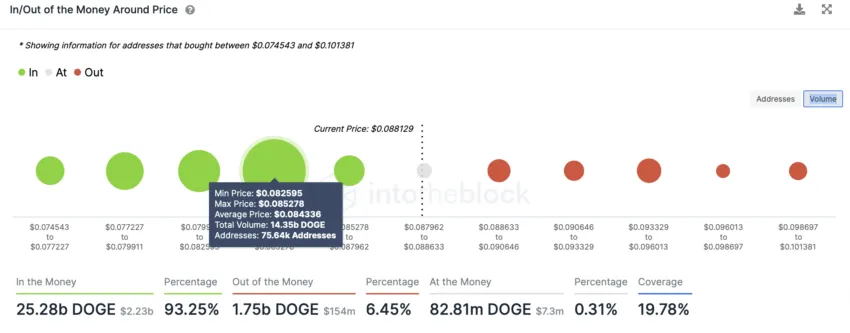

For DOGE In/Out of Money Around Price Indicator from IntoTheBlock showed the next support at $0.084, where 75,640 addresses hold 14.35 billion DOGE.

On the upside, there seemed to be no major barrier until the $0.100 mark, which can aid some decent upside for DOGE price.

Atsakomybės apribojimas: „BeInCrypto“ siekia pateikti tikslią ir naujausią informaciją, tačiau ji nebus atsakinga už trūkstamus faktus ar netikslią informaciją. Jūs laikotės ir suprantate, kad bet kokią šią informaciją turėtumėte naudoti savo rizika. Kriptovaliutos yra labai nepastovus finansinis turtas, todėl tyrinėkite ir priimkite savo finansinius sprendimus.

Atsakomybės neigimas

Visa mūsų svetainėje esanti informacija skelbiama sąžiningai ir tik bendro pobūdžio informacijos tikslais. Bet kokie veiksmai, kuriuos skaitytojas imasi remdamasis mūsų svetainėje esančia informacija, yra griežtai jų pačių rizika.

Source: https://beincrypto.com/dogecoin-doge-price-jumps-14-after-brutal-short-squeeze/