Pagrindiniai klausimai:

- Five banks, including Capital One and KeyBank, failed to comply with the New York City Banking Commission’s designation process, which requires filing certificates concerning non-discrimination policies.

- As a result, the New York City Comptroller froze their deposits for not demonstrating efforts to eliminate discrimination and being responsible managers of public funds.

Capital One and KeyBank had deposits frozen by New York City Comptroller for failing to show efforts in eliminating discrimination. NYC requires banks to comply with non-discrimination policies.

Capital One and KeyBank have had their deposits frozen by the New York City Comptroller, along with the NYC Mayor and the Department of Finance. The banks failed to submit plans that demonstrated their efforts to eliminate discrimination, so the freeze was put in place. Banks that want to do business with New York City must show that they are responsible managers of public funds and of the community.

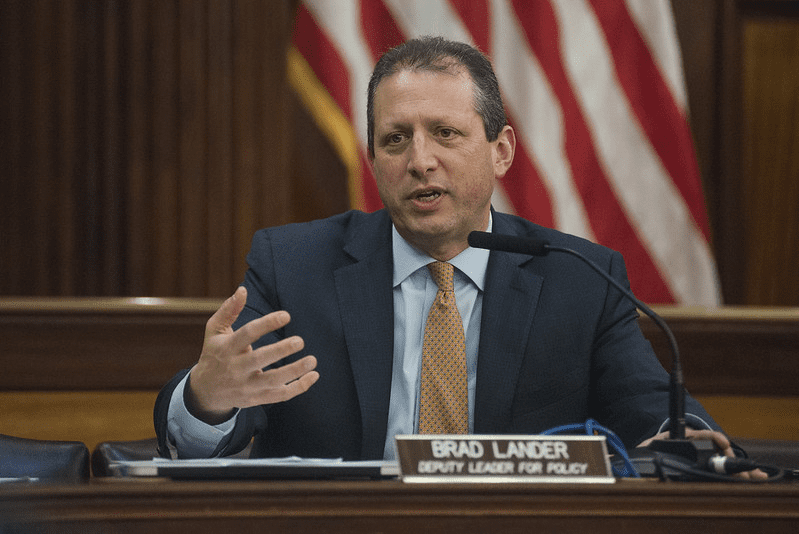

According to New York City Comptroller Brad Lander, five banks failed to comply with the New York City Banking Commission’s designation process, concluding that they are not taking meaningful actions to combat discrimination in their operations and are not responsible stewards of public funds.

Lander expressed his appreciation to the Mayor, the Finance Commissioner, the Treasurer, the Banking Commission Member, and the Department of Finance for working together to strengthen oversight over banks that profit from public funds.

The NYC Banking Commission requires banks to file certificates concerning their non-discrimination policies in hiring, promoting, and delivering banking services and for bank closings to comply with designation requirements. KeyBank and Capital One were two of the five banks that failed to do so, hence the freeze.

Capital One held $7.2 million in City deposits across 108 accounts, while KeyBank held $10 million in City deposits across three accounts at the end of April. Both banks refused to submit the required policies, leading to the freeze. Despite the freeze, both banks can still service existing contracts, but only for one year.

ATSAKOMYBĖS APRIBOJIMAS: Informacija šioje svetainėje pateikiama kaip bendras rinkos komentaras ir nėra investavimo patarimas. Rekomenduojame prieš investuojant atlikti savo tyrimą.

Prisijunkite prie mūsų, kad galėtumėte sekti naujienas: https://linktr.ee/coincu

Tana

Coincu Naujienos

Source: https://news.coincu.com/190018-nyc-comptroller-freezes-deposit-capital-one/