- Solana’s key DeFi indicators showed signs of recovery in an otherwise under par February

- SOL’s high volatility kept investors on their toes

According to an 18 February tweet by Kamino Finance, Solanos [SOL] decentralized exchange (DEX) activity was better than other chains in 2023 if a particular metric was put into consideration.

DeFi velocity has recently proved an interesting metric in gauging the vitality of @soliariumas defi

According to recent statistics, Solana has displayed by far the highest velocity of all DeFi ecosystems

Here’s why it matters👇

— Kamino Finance (@Kamino_Finance) Vasaris 17, 2023

Kiek yra Šiandien verta 1,10,100 XNUMX XNUMX SOL?

Called ‘DeFi Velocity’, the metric basically measures the trading volume versus total value locked (TVL) on a blockchain. The report highlighted that Solana’s average DeFi velocity for January stood at 0.25, more than twice of the second-ranked Daugiakampis [MATIC] sąraše.

DeFi recovery on the cards?

Solana witnessed an uptick in its DeFi activity with its TVL registering a 6% jump over the last week, data from DeFiLlama pointed out. This development came even as Solana per mažai in the month of February, impacted by a waning interest in its ambitious meme coin, BONKAS.

The chain’s daily DEX trading volume also showed signs of a rebound after it more than doubled at the time of writing, plunging to a monthly low on 11 February. Despite this, the cumulative weekly volume dropped by 2.3%, highlighting the stress Solana has been in February.

What does SOL’s price say?

SOL has come out of the FTX-induced negativity to a great extent in 2023. According to data from CoinMarketCap, the token locked gains of 112% since the start of 2023. Of late, the price has exhibited higher volatility with wild inter-day swings. At press time, it was valued at $22.99 with a 1.69% jump from the previous day.

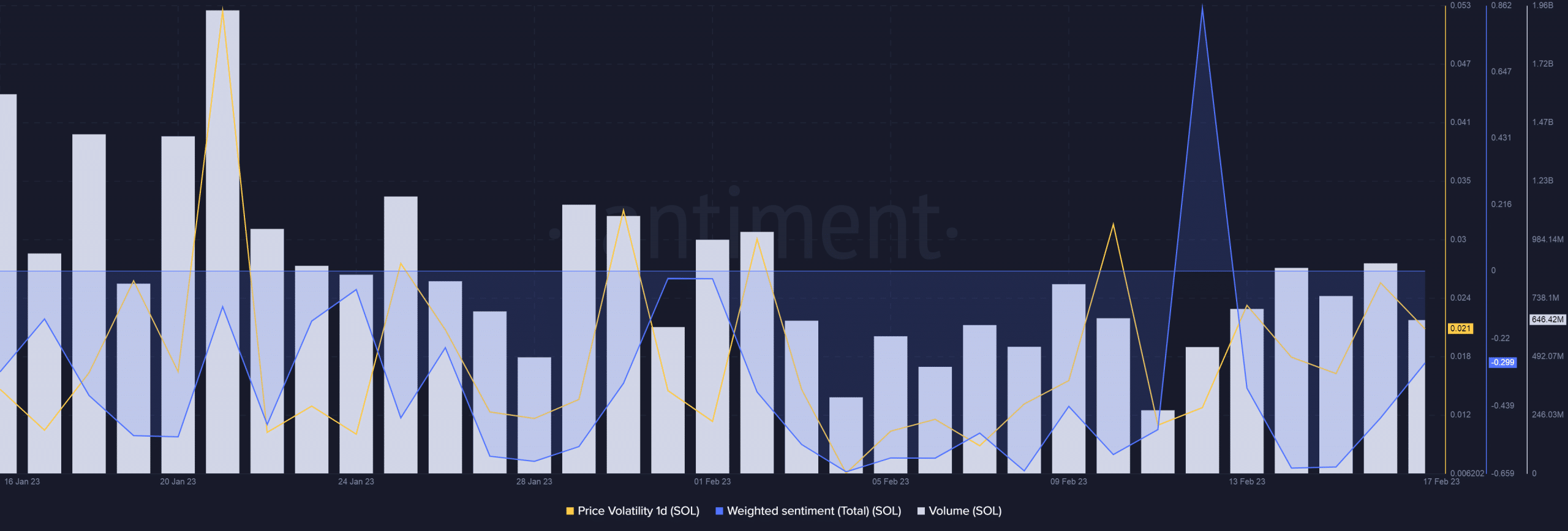

Data from Santiment complimented the above claim. The price volatility steadily increased over the past week, which placed the weighted sentiment in negative territory. High volatility could have prompted risk-averse traders to stay away from trading the coin.

Ar jūsų portfelis žalias? Patikrinkite Solana pelno skaičiuoklė

The transaction volume, which recorded a nearly 60% month-over-month drop, was a testament to the declining investor’s sentiment.

Solana’s Open Interest (OI) steadily declined over the last 30 days, data from Coinalyze pointed out. A decline in Open Interest signals reduced trading activity and market interest for the coin. With the OI forming a bearish divergence, SOL’s price could face further downsides in the short term.

Source: https://ambcrypto.com/sol-prevails-in-the-defi-landscape-but-testing-times-remain/